When it comes to home improvement, many homeowners find themselves in need of a loan to fund their projects. But did you know that you can secure a home improvement loan using your existing mortgage? This option allows you to leverage the equity in your home to finance renovations, repairs, or upgrades. By combining your mortgage and home improvement loan, you can simplify the borrowing process and potentially access lower interest rates.

Obtaining a home improvement loan with a mortgage involves considering a few important factors. First, you’ll need to evaluate how much equity you have in your home, as this will determine the amount you can borrow. It’s crucial to have a clear understanding of the specific improvements or renovations you plan to make, as this will help you determine the loan amount needed. Additionally, it’s important to compare different lenders and loan options to secure the most favorable terms and rates. By carefully navigating these steps, you can successfully obtain a home improvement loan with a mortgage and make your desired renovations a reality.

Can You Combine a Home Improvement Loan with Your Mortgage?

When it comes to financing home improvements, many homeowners wonder if it’s possible to add a home improvement loan to their existing mortgage. This can be an attractive option for those looking to fund renovations or repairs without taking on additional debt separate from their mortgage. In this article, we will explore whether it is possible to combine a home improvement loan with your mortgage and how this process works.

Typically, there are two main ways to include a home improvement loan in your mortgage. The first option is through refinancing your mortgage, where you replace your current mortgage with a new one that includes the additional funds for your home improvement project. The second option is through a renovation loan, which allows you to borrow against the equity in your home to fund the renovations or repairs.

How Do Mortgages Work with Renovations?

Renovating a home can be an exciting project, but it often requires a significant amount of funding. Many homeowners wonder how they can finance their renovations while also managing their mortgage payments. This article will explain how mortgages work with renovations and provide valuable insights on how to get a home improvement loan with a mortgage.

A mortgage is a type of loan that is used to purchase or refinance a property. It allows borrowers to borrow a large sum of money from a lender, which is typically repaid over a long period of time with interest. When it comes to renovations, homeowners have a few options for financing their projects. One common method is to refinance their existing mortgage to include the additional funds needed for the renovation. This allows homeowners to take advantage of lower interest rates and extend the loan term to cover the cost of the renovations.

What Credit Score is Required for a Home Improvement Loan?

A home improvement loan can be a great way to fund renovations and upgrades to your property. However, one common question that borrowers have is regarding the credit score requirement for obtaining a home improvement loan. Your credit score plays a significant role in determining your eligibility and the terms of the loan.

In general, a higher credit score will increase your chances of being approved for a home improvement loan. Lenders typically prefer borrowers with good to excellent credit scores, which are usually considered to be 670 or above. This is because a higher credit score is an indication of responsible financial behavior and lowers the lender’s risk.

Are Renovation Loans a Smart Choice for Home Improvements?

Renovation loans can be a valuable financial tool for homeowners seeking to fund home improvement projects. These loans are specifically designed to help individuals cover the costs of renovations, repairs, or upgrades to their existing property. With the option to consolidate expenses into their mortgage, homeowners can access the funds they need while potentially increasing the value of their home.

Unlike traditional personal loans or lines of credit, renovation loans offer several advantages. One of the main benefits is the ability to borrow against the equity in your home. This means that you can potentially secure a larger loan amount with more favorable interest rates compared to other forms of financing. Additionally, renovation loans often come with flexible repayment terms, allowing homeowners to spread out the cost of their renovations over an extended period.

Are government loans available for home remodeling?

Government loans can be a valuable resource for homeowners looking to remodel their homes. These loans are specifically designed to provide financial assistance to individuals who want to make improvements or repairs to their properties. By offering competitive interest rates and flexible repayment terms, government loans make it easier for homeowners to fund their remodeling projects.

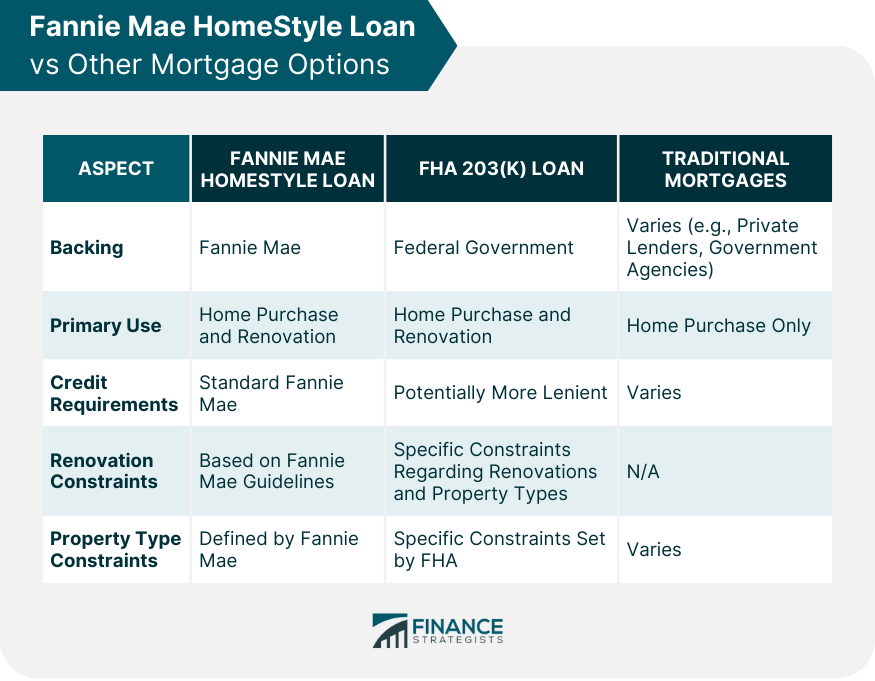

One popular type of government loan for home remodeling is the FHA 203(k) loan. This loan program allows homeowners to borrow funds for both the purchase of a property and the cost of renovations. By combining the mortgage and renovation expenses into one loan, homeowners can simplify the borrowing process and potentially save on interest payments.

Looking for a Home Improvement Loan Calculator?

Discover an easy way to estimate your home improvement loan with our user-friendly calculator.

Whether you’re planning to remodel your kitchen, add an extra room, or upgrade your bathroom, a home improvement loan can provide the necessary funds to turn your dreams into reality. But how do you determine the amount you can borrow and what your monthly payments will be? That’s where our home improvement loan calculator comes in handy.

How can I obtain a home improvement loan using a mortgage?

A home improvement loan is a type of loan specifically designed to help homeowners finance renovations, repairs, or additions to their property. These loans can be used to fund a wide range of home improvement projects, such as kitchen remodels, bathroom renovations, roof repairs, or even building an extension to your home.

When it comes to obtaining a home improvement loan using a mortgage, there are a few options available. One option is to refinance your existing mortgage and include the additional funds needed for the home improvements in the new loan. This allows you to take advantage of potentially lower interest rates and spread the cost of your home improvements over a longer period of time.

How can you obtain a home improvement loan with a mortgage?

A home improvement loan with a mortgage allows you to finance renovation or remodeling projects for your property. This type of loan offers the advantage of combining your home loan and improvement expenses into one convenient package. By rephrasing “zero interest home improvement loans” into a question, we address the specific concern of obtaining a loan for home improvements while having a mortgage.

In order to get a home improvement loan with a mortgage, you typically need to follow a few steps. Firstly, you should assess the value of your property and estimate the cost of the improvements you want to make. Then, you can contact lenders or financial institutions to inquire about their loan options. It’s important to compare interest rates, repayment terms, and any additional fees or requirements associated with the loan. Once you choose a suitable lender, you will need to provide the necessary documentation, such as proof of income, credit history, and details about the proposed home improvements. The lender will evaluate your application and, if approved, provide you with the loan amount to fund your home improvement project.

How can I get a home improvement loan with a mortgage?

A home improvement loan is a type of loan that allows homeowners to borrow money to make renovations or upgrades to their property. These loans are specifically designed to help homeowners finance home improvement projects, such as remodeling a kitchen, adding an extension, or renovating a bathroom.

One way to get a home improvement loan with a mortgage is through an FHA home improvement loan. The Federal Housing Administration (FHA) offers a program called the FHA 203(k) loan, which is specifically designed for home improvement projects. This loan allows homeowners to borrow money to finance both the purchase of a property and the cost of renovations or repairs.

What are the advantages of a 10-year home improvement loan?

A 10-year home improvement loan offers numerous benefits for homeowners looking to finance renovations or upgrades. This type of loan provides a fixed term and interest rate over a 10-year period, making it a reliable and cost-effective option for funding home improvement projects.

One of the main advantages of a 10-year home improvement loan is that it allows homeowners to spread out the cost of renovations over a longer period, reducing the financial burden. With a fixed interest rate, borrowers can accurately plan their budget and make consistent monthly payments without worrying about unexpected rate increases.

How can I obtain a home improvement loan using a mortgage calculator?

Are you looking to make improvements to your home but need financial assistance? One option to consider is obtaining a home improvement loan. With the help of a mortgage calculator, you can determine the amount you can borrow based on your home’s value and your financial situation. This article will guide you through the process of getting a home improvement loan using a mortgage calculator, ensuring that you make informed decisions about your home improvement project.

A home improvement loan is a type of loan specifically designed to fund renovations, repairs, or upgrades to your property. These loans provide you with the necessary funds to make your home more comfortable, functional, and aesthetically pleasing. Unlike a traditional mortgage loan, a home improvement loan is typically unsecured, meaning that you don’t need to offer your home as collateral. This can be advantageous as it reduces the risk of foreclosure in case you are unable to make the loan payments.

Looking for a Home Improvement Loan with Mortgage? Find out about Wells Fargo’s Options

Are you planning to make significant renovations to your home but don’t have the funds readily available? Wells Fargo offers home improvement loans that can help you finance your projects. These loans allow you to borrow money specifically for home improvements, giving you the flexibility to make the necessary changes to your property.

With Wells Fargo’s home improvement loans, you can enjoy various advantages. Firstly, these loans typically have lower interest rates compared to other types of loans, making them a cost-effective option for financing your home improvements. Additionally, Wells Fargo offers flexible repayment terms, allowing you to choose a repayment plan that suits your financial situation.

Obtaining a home improvement loan with a mortgage is a viable option for homeowners looking to enhance their living spaces. By leveraging the value of their property, homeowners can secure the funds needed to complete their desired renovations.

When applying for a home improvement loan with a mortgage, it is important for homeowners to consider factors such as their credit score, income stability, and the equity they have in their property. Lenders will assess these elements to determine the loan amount and interest rate. Homeowners should also research different mortgage options and compare rates and terms from various lenders to find the best fit. By carefully assessing their financial situation and understanding the loan process, homeowners can successfully obtain a home improvement loan with a mortgage and create the home of their dreams.