Finance lease is a popular option for businesses looking to acquire assets without the upfront costs. It allows companies to use an asset for a specific period of time while paying fixed monthly payments. But like any financial arrangement, finance lease has its pros and cons.

One of the advantages of finance lease is that it provides businesses with access to high-value assets that they may not be able to afford outright. This can be particularly beneficial for small businesses that want to expand their operations without putting a strain on their cash flow. Additionally, finance lease offers tax benefits, as the lease payments may be tax-deductible, further reducing the overall cost of the asset.

What are the pros and cons of lease financing?

Lease financing, also known as finance leasing, is a popular option for businesses to acquire assets without having to purchase them outright. It involves entering into an agreement with a leasing company, where the lessee pays regular lease payments in exchange for the use of the asset. While lease financing offers certain advantages, it also has its downsides. This article will discuss the pros and cons of lease financing.

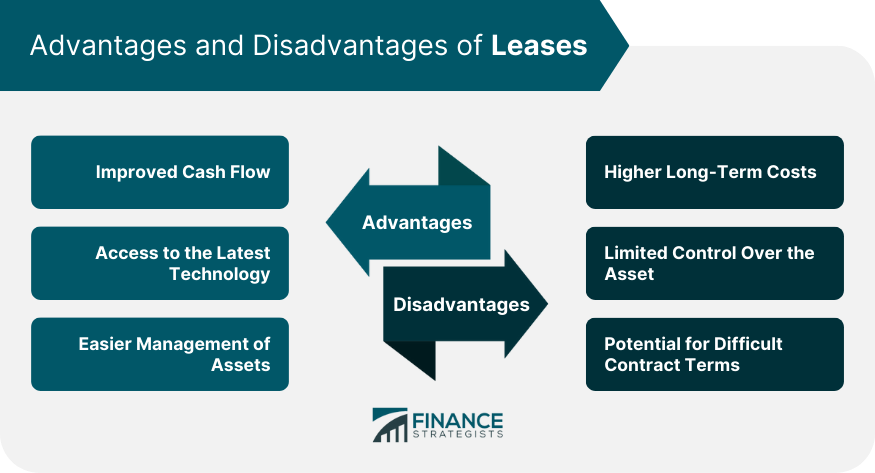

Pros of lease financing:

- Lower upfront costs: Unlike purchasing an asset, lease financing allows businesses to acquire the use of an asset with minimal upfront costs. This can be beneficial for companies that may not have the capital to make a large purchase.

- Tax advantages: Lease payments are often considered as operating expenses, which can be deducted from the business’s taxable income. This can result in tax savings for the lessee.

- Flexibility: Lease financing offers flexibility in terms of asset management. At the end of the lease term, businesses can choose to return the asset, renew the lease, or even purchase the asset at a predetermined price.

Cons of lease financing:

- Higher overall cost: Lease financing typically comes with a higher total cost compared to purchasing an asset outright. This is because businesses are paying for the use of the asset over a specific period, along with any interest or fees associated with the lease agreement.

- No ownership rights: With lease financing, businesses do not have ownership rights to the asset. This means they do not benefit from any potential appreciation in value or have the freedom to make modifications or sell the asset.

- Potential restrictions: Lease agreements may come with certain restrictions, such as mileage limits for vehicles or prohibitions on making alterations to leased equipment. These restrictions can limit the business’s flexibility and control over the asset.

What is the main benefit of a financial lease?

A financial lease comes with several advantages for businesses. One of the key benefits of a financial lease is…

When considering the pros and cons of a finance lease, it is important to understand the main advantage it offers. With a financial lease, businesses can…

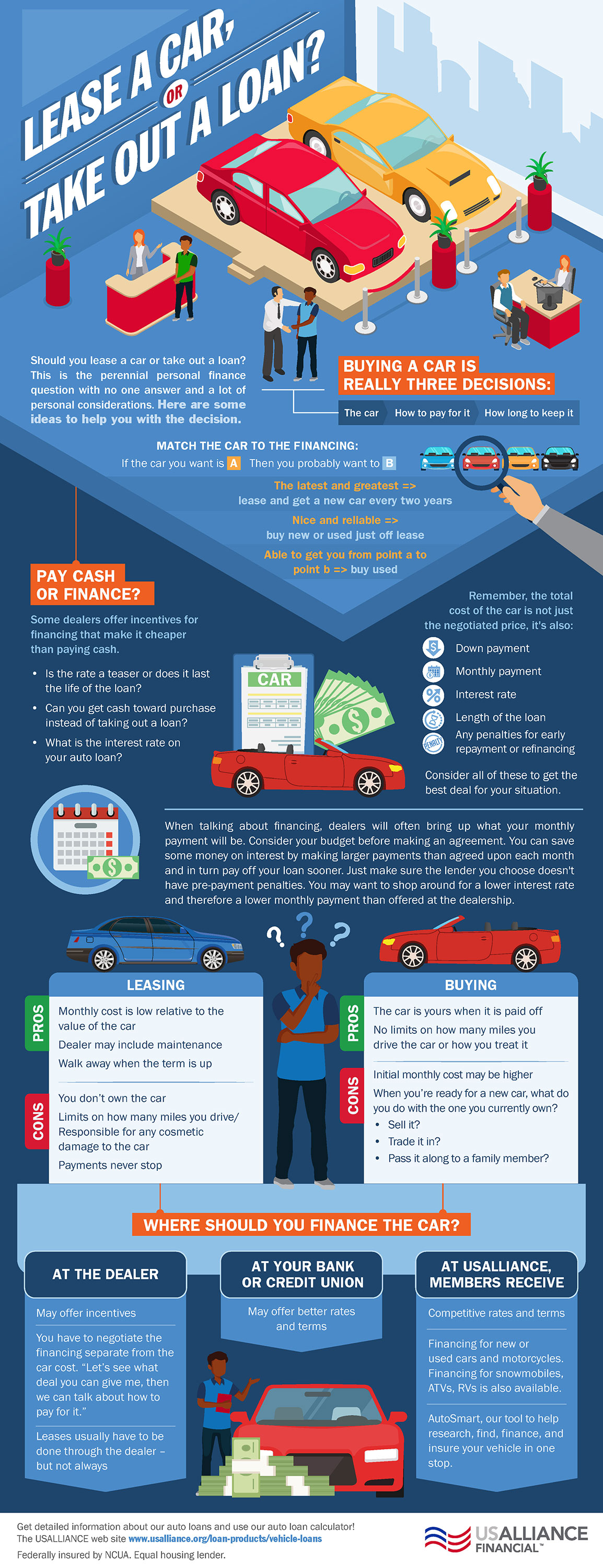

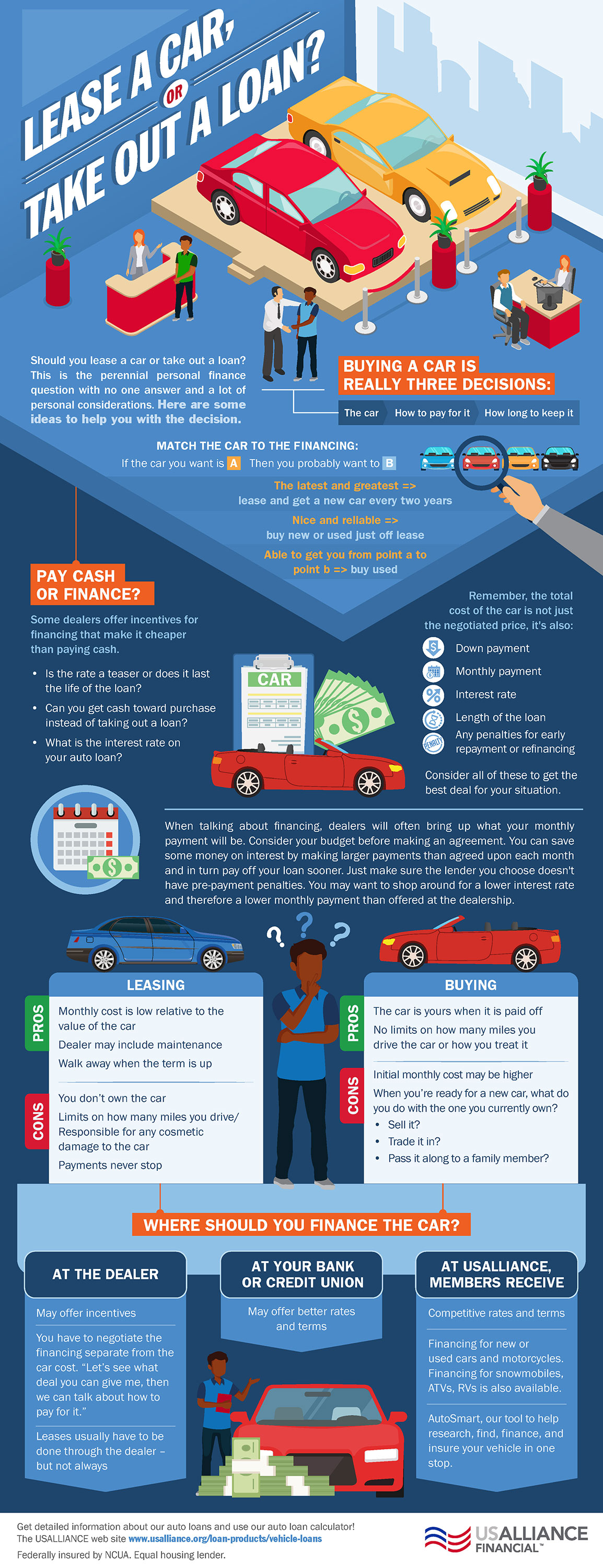

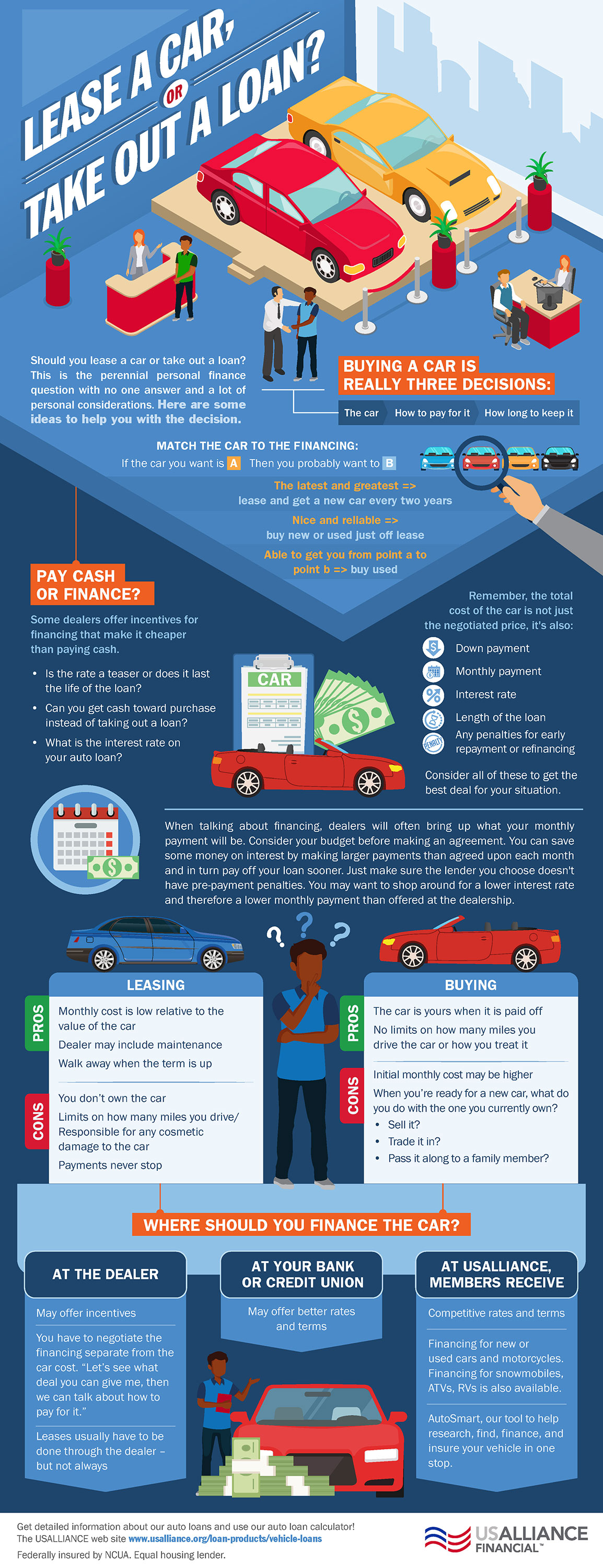

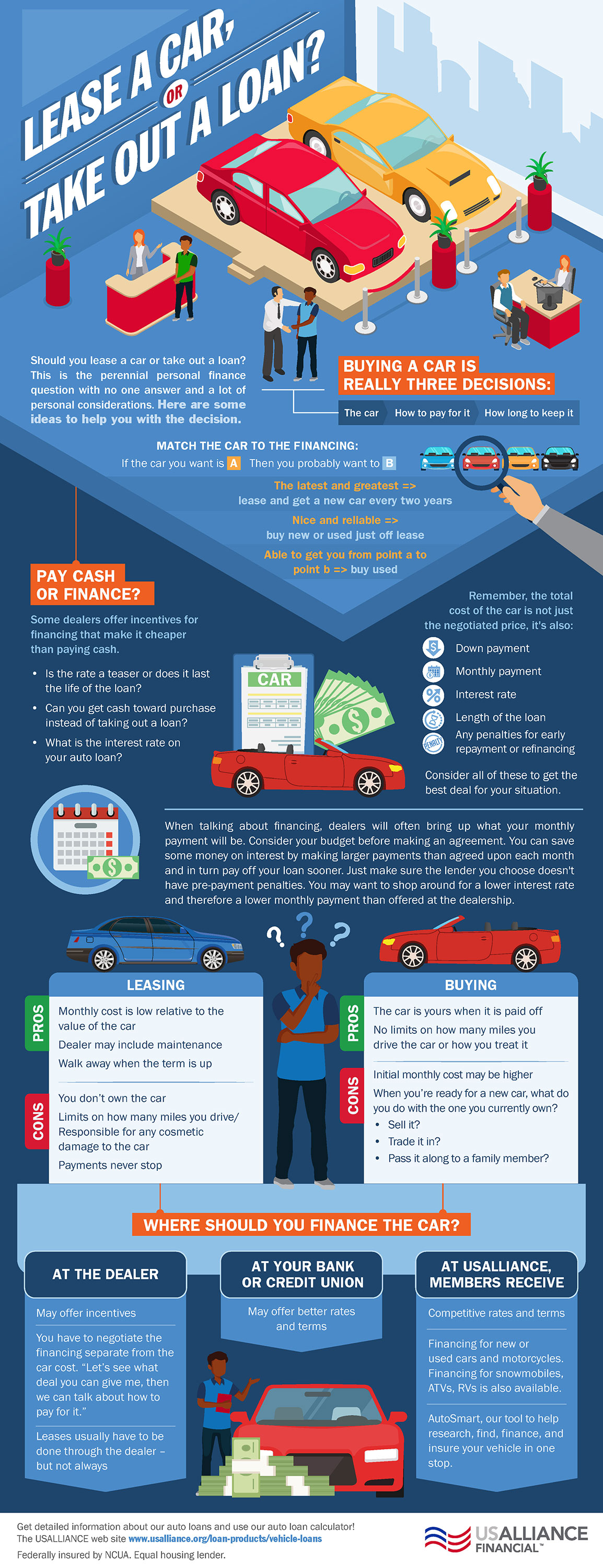

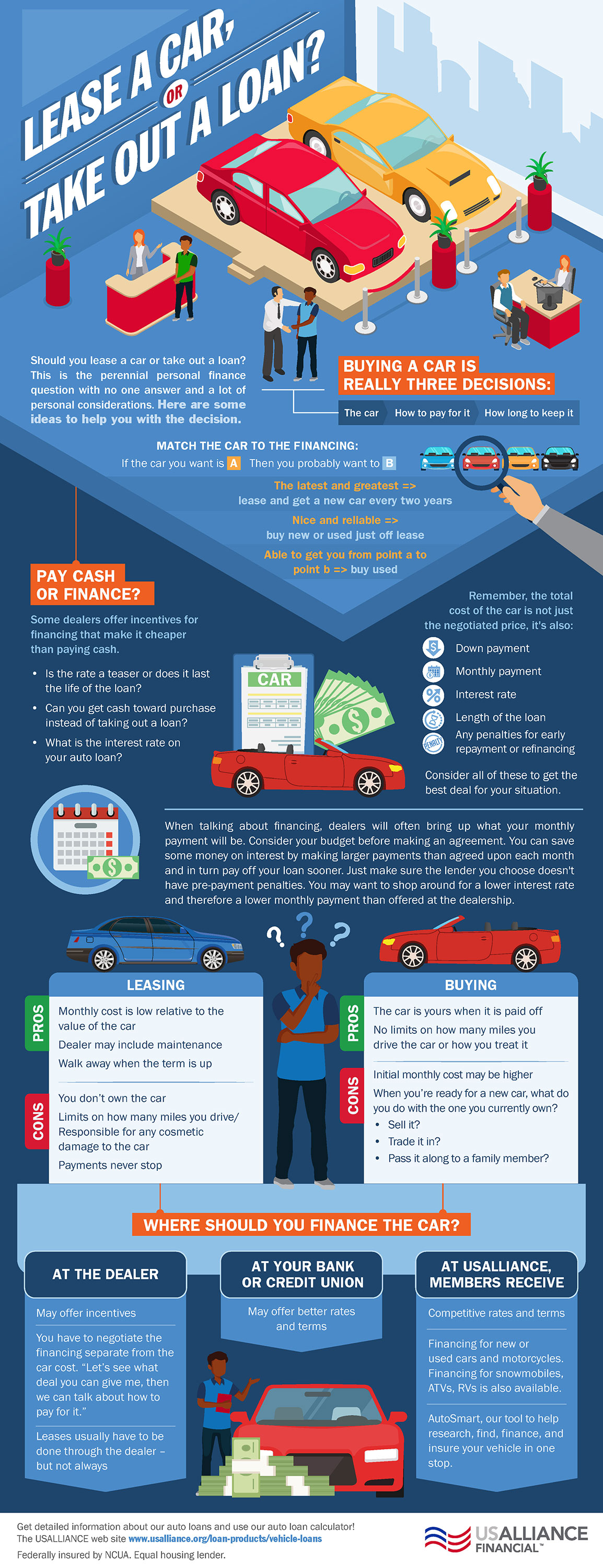

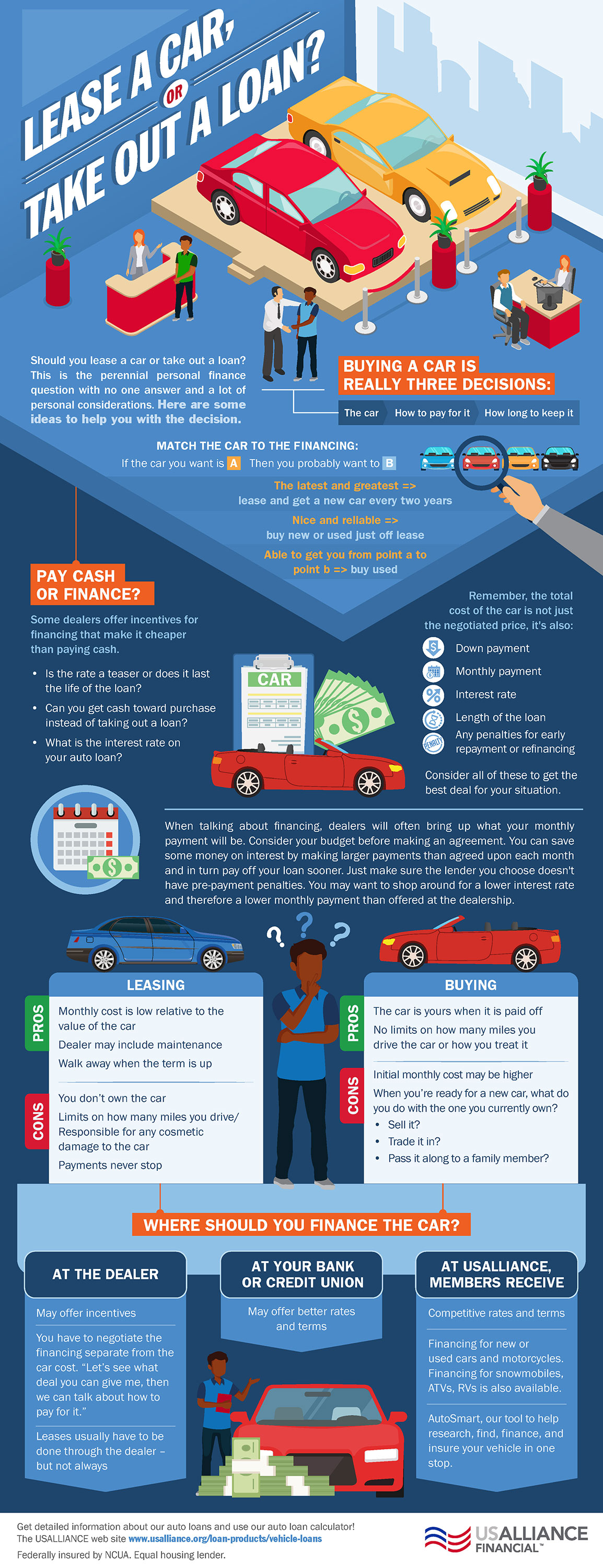

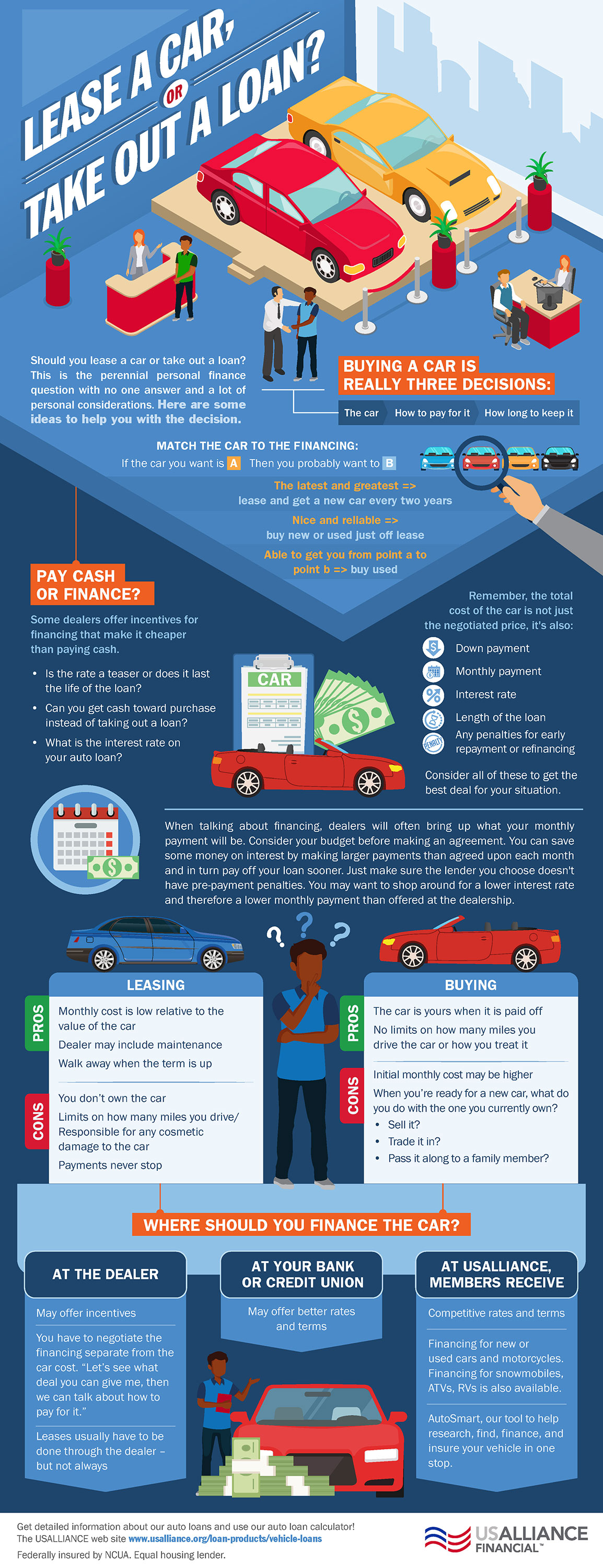

Which is the better option: leasing or financing?

Leasing or financing? It’s a common dilemma when it comes to acquiring a new asset. Whether you’re looking to lease a car or finance a piece of equipment for your business, choosing the right option can have a significant impact on your financial situation. In this article, we will explore the pros and cons of a finance lease to help you make an informed decision.

A finance lease, also known as a capital lease, is a type of lease agreement that allows you to have ownership of the asset while making regular lease payments. This option is suitable for businesses that need to use the asset for a long period and want to have the benefits of ownership without making a large upfront purchase. Here are some advantages and disadvantages of a finance lease:

Pros of Finance Lease:

What are the pros and cons of finance lease?

In this article, we will explore the advantages and disadvantages of finance lease, a popular form of lease financing. Understanding the pros and cons of finance lease can help businesses make informed decisions about their financing options.

A finance lease, also known as a capital lease, is a type of lease agreement where the lessee (the business) obtains the right to use an asset for a specific period of time in exchange for regular lease payments. At the end of the lease term, the lessee has the option to purchase the asset at a predetermined price, typically known as a residual value.

Advantages of Finance Lease

One of the main advantages of finance lease is that it allows businesses to acquire and use assets without the need for a large upfront capital investment. This is especially beneficial for small and medium-sized enterprises (SMEs) that may have limited financial resources.

Additionally, finance lease offers tax advantages for businesses. In many countries, lease payments can be treated as operating expenses and deducted from taxable income. This can result in lower tax liabilities for businesses, freeing up more cash for other operational needs.

Disadvantages of Finance Lease

One of the limitations of finance lease is that the lessee is responsible for the maintenance and repair costs of the leased asset. This can add additional expenses to the overall cost of leasing the asset, which may impact the financial viability of the arrangement.

Furthermore, because the lessee does not own the asset during the lease term, they are unable to benefit from any potential appreciation in the asset’s value. This means that they do not have the option to sell the asset or use it as collateral for other financing needs.

What are the advantages and disadvantages of finance leasing in business?

A finance lease is a popular method of acquiring assets for businesses. It allows businesses to use and benefit from assets without having to purchase them outright. Instead, the assets are leased over a specific period of time, with fixed monthly payments. This arrangement comes with its own set of advantages and disadvantages.

Advantages of Finance Leasing

There are several advantages of finance leasing for businesses:

- Cost-effective: Finance leasing allows businesses to acquire assets without a large upfront investment. Instead, they can make fixed monthly payments over a specific period of time, which helps with budgeting and cash flow management.

- Tax benefits: In many countries, finance lease payments can be deducted as a business expense, which can result in significant tax savings.

- Flexibility: Finance leasing gives businesses the flexibility to upgrade or replace assets easily. At the end of the lease term, businesses can choose to return the assets, purchase them at a predetermined price, or enter into a new lease agreement for upgraded assets.

- Access to latest technology: Leasing allows businesses to access and utilize the latest technology and equipment, without the need for significant capital investment.

- Off-balance sheet financing: Finance lease arrangements are considered off-balance sheet financing, which can improve a business’s financial ratios and make it more attractive to potential investors or lenders.

Disadvantages of Finance Leasing

Despite its advantages, finance leasing also has some disadvantages that businesses should consider:

- Higher overall cost: While finance leasing can be cost-effective in the short term, it may result in a higher overall cost compared to purchasing the assets outright. This is because businesses are essentially renting the assets and paying interest on the lease.

- Limited ownership rights: When leasing assets, businesses do not have full ownership rights. They are limited in how they can use, modify, or sell the assets.

- Long-term commitment: Finance lease agreements typically have a fixed term, which means businesses are committed to making regular payments for the entire duration of the lease. Exiting the lease early can result in penalties or additional costs.

- Depreciation risk: Businesses bear the risk of asset depreciation during the lease term. If the value of the assets significantly decreases, it may impact the business’s ability to recover the costs when returning or purchasing the assets.

Should you lease a car? Discover the pros and cons of finance lease

Leasing a car can be an attractive option for many individuals, providing a convenient and cost-effective way to drive a new vehicle. However, it’s important to weigh the advantages and disadvantages before making a decision. In this article, we’ll explore the pros and cons of finance lease, helping you determine whether it’s the right choice for you.

When considering a finance lease, it’s crucial to understand both the benefits and drawbacks. Let’s take a closer look at the advantages and disadvantages of leasing a car:

Advantages of Finance Lease

- Lower monthly payments compared to buying

- Ability to drive a new car every few years

- No need to worry about depreciation

- Minimal upfront costs

- Potential tax benefits for business use

Disadvantages of Finance Lease

- No ownership at the end of the lease term

- Mileage restrictions and penalties for exceeding them

- Additional costs for wear and tear

- Difficult to terminate the lease early

- Potential for higher insurance premiums

What are the disadvantages of leasing a car?

Leasing a car can have its advantages, but it also comes with a set of disadvantages. In this article, we will explore the drawbacks of leasing a car and help you make an informed decision.

When it comes to leasing a car, one of the main disadvantages is the lack of ownership. Unlike buying a car, where you eventually become the owner after paying off the loan, leasing only gives you temporary possession of the vehicle. This means that you don’t have the option to modify or customize the car to your liking.

Another disadvantage of leasing a car is the mileage restrictions. Most lease agreements come with a set mileage limit, and if you exceed that limit, you may have to pay additional fees. This can be a problem for people who have long commutes or enjoy road trips.

What are the advantages and disadvantages of leasing a car?

Leasing a car can be an attractive option for many individuals, but it’s important to understand the pros and cons before making a decision. In this article, we will explore the advantages and disadvantages of leasing a car, specifically focusing on finance lease arrangements.

First, let’s define what a finance lease is. A finance lease is a type of lease agreement where the lessee (the person leasing the car) assumes most of the risks and rewards of ownership. The lessee is responsible for maintenance and repairs, insurance, and other associated costs during the lease term. At the end of the lease, the lessee usually has the option to purchase the car at a predetermined price.

What are the advantages of leasing a car?

Leasing a car can offer several benefits compared to buying a vehicle outright. Let’s explore some of the advantages of leasing a car:

1. Lower Monthly Payments

One of the main advantages of leasing a car is that it typically comes with lower monthly payments compared to financing a car purchase. When you lease, you are essentially paying for the depreciation of the vehicle over the lease term, rather than the full cost of the car. This can result in more affordable monthly payments, allowing you to drive a newer or higher-end vehicle for less money.

2. Access to Newer Vehicles

Leasing a car allows you to regularly upgrade to newer models. Most lease terms are around 2-3 years, which means you can enjoy the latest features, technology, and safety advancements in the automotive industry. This is especially beneficial for those who prefer driving the latest vehicles and want to avoid the hassle of selling or trading in their cars every few years.

What are the disadvantages of leasing?

Leasing is a popular option for individuals and businesses looking to acquire assets without the upfront cost of purchasing. However, like any financial decision, there are pros and cons to consider. In this article, we will discuss the disadvantages of leasing, specifically focusing on finance leases.

Finance leases are a form of leasing where the lessee assumes most of the risks and rewards of ownership during the lease term. While they offer certain advantages, such as flexibility and potential tax benefits, there are also drawbacks to be aware of.

Should You Lease or Finance a Car? Pros and Cons of Finance Lease

When it comes to acquiring a new car, one of the most important decisions you’ll have to make is whether to lease or finance it. Both options have their advantages and disadvantages, so it’s crucial to weigh them carefully before making a choice. In this article, we will explore the pros and cons of finance lease, providing you with the information you need to make an informed decision.

A finance lease, also known as a car loan, involves borrowing money from a lender to purchase a vehicle. The borrower agrees to make monthly payments, including interest, over a predetermined period of time. At the end of the loan term, the borrower becomes the owner of the car.

What are the pros and cons of finance leasing?

In this article, we will explore the advantages and disadvantages of finance leasing. Finance leasing is a popular method used by businesses to acquire assets, such as equipment or vehicles, without the need for a large upfront payment. Instead, the business enters into a lease agreement with a leasing company, paying regular installments over an agreed period of time.

One of the main advantages of finance leasing is that it allows businesses to conserve their cash flow. Instead of making a significant upfront payment to purchase the asset, the business can spread the cost over a longer period of time. This can be particularly beneficial for businesses that require expensive equipment or vehicles but do not have the immediate funds available.

Leasing VS. Financing A Car | Is It Better To Buy Or Lease A New Car?

Frequently Asked Questions

Here are some common questions and answers regarding the pros and cons of finance lease:

1. What are the advantages of a finance lease?

Finance leases offer several benefits:

Firstly, finance leases provide businesses with the flexibility to acquire assets with minimal upfront cost. This can be particularly advantageous for companies that require expensive machinery or equipment.

Secondly, finance leases often come with lower monthly payments compared to other forms of financing, such as loans or hire purchase. This can help companies manage their cash flow more effectively and allocate resources to other areas of their business.

2. Are there any drawbacks to finance leases?

While finance leases can be beneficial, there are some potential drawbacks:

One disadvantage is that finance leases typically involve long-term commitments, often lasting for the useful life of the leased asset. This can limit the flexibility of businesses, as they may be locked into contracts even if their needs change.

Additionally, finance leases usually require regular payments, which can be a burden for businesses experiencing financial difficulties or cash flow challenges. Falling behind on lease payments can result in penalties or even the repossession of the leased asset.

3. How does a finance lease affect the balance sheet?

A finance lease affects the balance sheet by classifying the leased asset as a liability and recognizing the corresponding lease obligation. This allows the business to use the asset without showing it as an outright purchase.

On the asset side of the balance sheet, the leased asset is listed under “Property, Plant, and Equipment” or a similar category. On the liability side, the lease obligation is recorded as a long-term liability.

4. Can a finance lease be terminated early?

In most cases, finance leases are legally binding contracts with little flexibility for early termination. However, some lease agreements may include clauses or provisions for early termination, albeit with potential penalties or financial implications.

It is important for businesses to carefully review the terms and conditions of a finance lease before entering into the agreement to understand their options and potential consequences in case early termination becomes necessary.

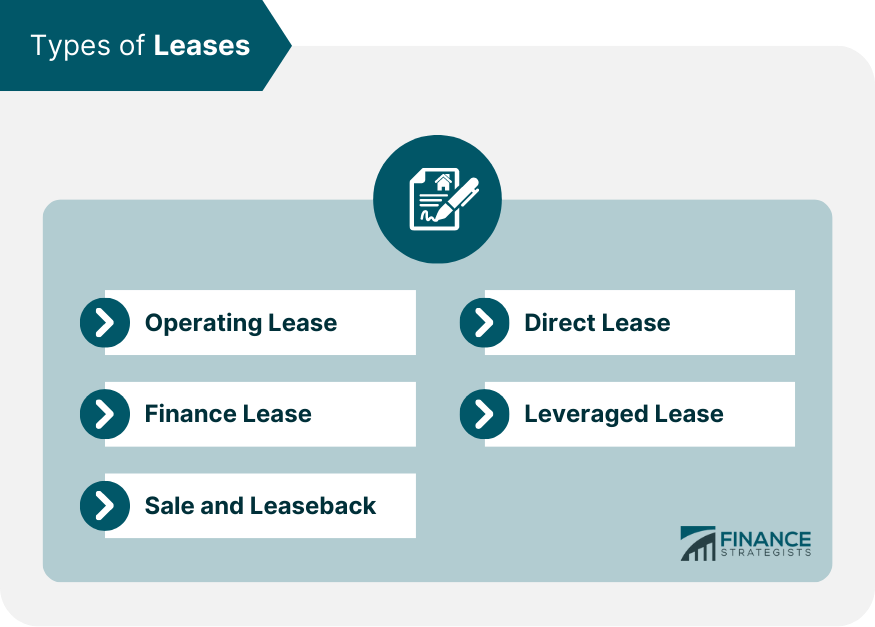

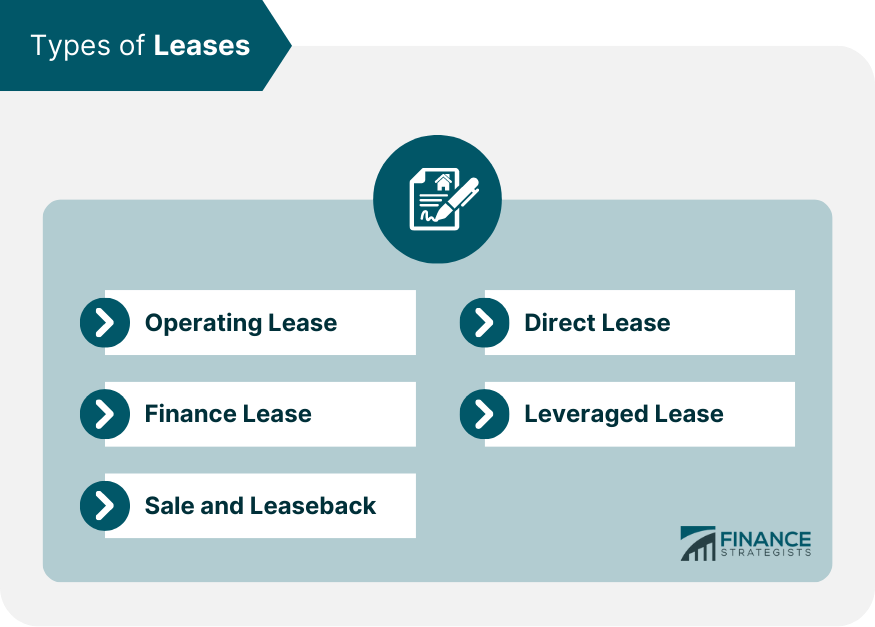

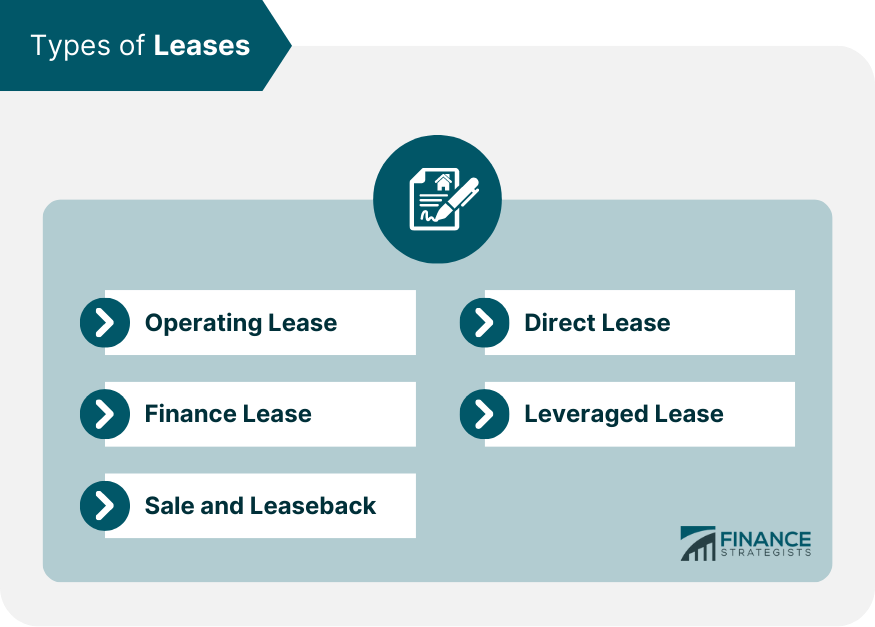

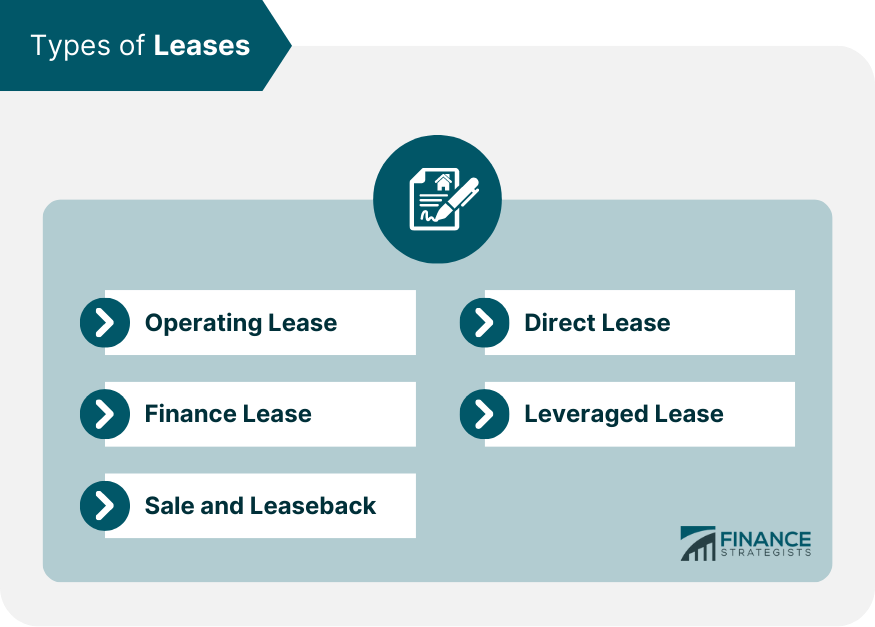

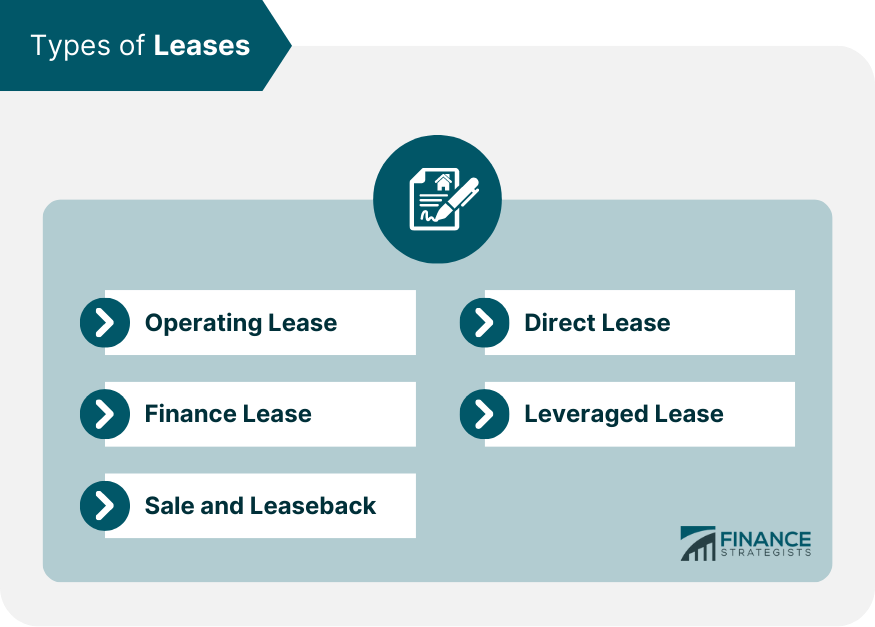

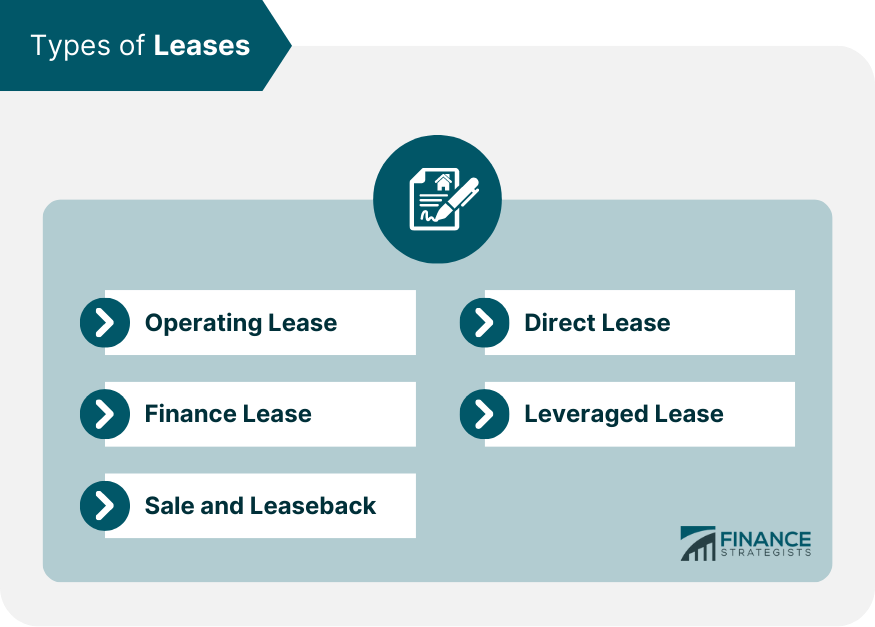

5. How does a finance lease differ from an operating lease?

A finance lease and an operating lease differ in terms of ownership and accounting treatment:

In a finance lease, the lessee bears the risks and rewards of ownership and records the leased asset and corresponding liability on their balance sheet. The lessee is responsible for maintenance, insurance, and other costs associated with the asset.

On the other hand, an operating lease is more similar to renting. The lessor retains ownership of the asset, and the lessee does not record the leased asset or liability on their balance sheet. The lessor typically assumes responsibility for maintenance and other costs.

In summary, finance leases have both advantages and disadvantages. On the positive side, they allow businesses to acquire assets without a large upfront payment, providing flexibility and preserving cash flow. Finance leases also allow for a greater degree of control and ownership over the asset and may offer tax benefits. However, there are drawbacks to consider as well.

One major disadvantage of finance leases is the long-term commitment and potential financial burden. Businesses are obligated to make regular lease payments over the lease term, which can impact their financial flexibility. Additionally, the lessee is responsible for maintenance, insurance, and repairs, which can add to the overall cost. It is crucial for businesses to carefully assess their specific needs and financial situation before entering into a finance lease.

What are the pros and cons of finance lease?

In this article, we will explore the advantages and disadvantages of finance lease, a popular form of lease financing. Understanding the pros and cons of finance lease can help businesses make informed decisions about their financing options.

A finance lease, also known as a capital lease, is a type of lease agreement where the lessee (the business) obtains the right to use an asset for a specific period of time in exchange for regular lease payments. At the end of the lease term, the lessee has the option to purchase the asset at a predetermined price, typically known as a residual value.

Advantages of Finance Lease

One of the main advantages of finance lease is that it allows businesses to acquire and use assets without the need for a large upfront capital investment. This is especially beneficial for small and medium-sized enterprises (SMEs) that may have limited financial resources.

Additionally, finance lease offers tax advantages for businesses. In many countries, lease payments can be treated as operating expenses and deducted from taxable income. This can result in lower tax liabilities for businesses, freeing up more cash for other operational needs.

Disadvantages of Finance Lease

One of the limitations of finance lease is that the lessee is responsible for the maintenance and repair costs of the leased asset. This can add additional expenses to the overall cost of leasing the asset, which may impact the financial viability of the arrangement.

Furthermore, because the lessee does not own the asset during the lease term, they are unable to benefit from any potential appreciation in the asset’s value. This means that they do not have the option to sell the asset or use it as collateral for other financing needs.

What are the advantages and disadvantages of finance leasing in business?

A finance lease is a popular method of acquiring assets for businesses. It allows businesses to use and benefit from assets without having to purchase them outright. Instead, the assets are leased over a specific period of time, with fixed monthly payments. This arrangement comes with its own set of advantages and disadvantages.

Advantages of Finance Leasing

There are several advantages of finance leasing for businesses:

- Cost-effective: Finance leasing allows businesses to acquire assets without a large upfront investment. Instead, they can make fixed monthly payments over a specific period of time, which helps with budgeting and cash flow management.

- Tax benefits: In many countries, finance lease payments can be deducted as a business expense, which can result in significant tax savings.

- Flexibility: Finance leasing gives businesses the flexibility to upgrade or replace assets easily. At the end of the lease term, businesses can choose to return the assets, purchase them at a predetermined price, or enter into a new lease agreement for upgraded assets.

- Access to latest technology: Leasing allows businesses to access and utilize the latest technology and equipment, without the need for significant capital investment.

- Off-balance sheet financing: Finance lease arrangements are considered off-balance sheet financing, which can improve a business’s financial ratios and make it more attractive to potential investors or lenders.

Disadvantages of Finance Leasing

Despite its advantages, finance leasing also has some disadvantages that businesses should consider:

- Higher overall cost: While finance leasing can be cost-effective in the short term, it may result in a higher overall cost compared to purchasing the assets outright. This is because businesses are essentially renting the assets and paying interest on the lease.

- Limited ownership rights: When leasing assets, businesses do not have full ownership rights. They are limited in how they can use, modify, or sell the assets.

- Long-term commitment: Finance lease agreements typically have a fixed term, which means businesses are committed to making regular payments for the entire duration of the lease. Exiting the lease early can result in penalties or additional costs.

- Depreciation risk: Businesses bear the risk of asset depreciation during the lease term. If the value of the assets significantly decreases, it may impact the business’s ability to recover the costs when returning or purchasing the assets.

Should you lease a car? Discover the pros and cons of finance lease

Leasing a car can be an attractive option for many individuals, providing a convenient and cost-effective way to drive a new vehicle. However, it’s important to weigh the advantages and disadvantages before making a decision. In this article, we’ll explore the pros and cons of finance lease, helping you determine whether it’s the right choice for you.

When considering a finance lease, it’s crucial to understand both the benefits and drawbacks. Let’s take a closer look at the advantages and disadvantages of leasing a car:

Advantages of Finance Lease

- Lower monthly payments compared to buying

- Ability to drive a new car every few years

- No need to worry about depreciation

- Minimal upfront costs

- Potential tax benefits for business use

Disadvantages of Finance Lease

- No ownership at the end of the lease term

- Mileage restrictions and penalties for exceeding them

- Additional costs for wear and tear

- Difficult to terminate the lease early

- Potential for higher insurance premiums

What are the disadvantages of leasing a car?

Leasing a car can have its advantages, but it also comes with a set of disadvantages. In this article, we will explore the drawbacks of leasing a car and help you make an informed decision.

When it comes to leasing a car, one of the main disadvantages is the lack of ownership. Unlike buying a car, where you eventually become the owner after paying off the loan, leasing only gives you temporary possession of the vehicle. This means that you don’t have the option to modify or customize the car to your liking.

Another disadvantage of leasing a car is the mileage restrictions. Most lease agreements come with a set mileage limit, and if you exceed that limit, you may have to pay additional fees. This can be a problem for people who have long commutes or enjoy road trips.

What are the advantages and disadvantages of leasing a car?

Leasing a car can be an attractive option for many individuals, but it’s important to understand the pros and cons before making a decision. In this article, we will explore the advantages and disadvantages of leasing a car, specifically focusing on finance lease arrangements.

First, let’s define what a finance lease is. A finance lease is a type of lease agreement where the lessee (the person leasing the car) assumes most of the risks and rewards of ownership. The lessee is responsible for maintenance and repairs, insurance, and other associated costs during the lease term. At the end of the lease, the lessee usually has the option to purchase the car at a predetermined price.

What are the advantages of leasing a car?

Leasing a car can offer several benefits compared to buying a vehicle outright. Let’s explore some of the advantages of leasing a car:

1. Lower Monthly Payments

One of the main advantages of leasing a car is that it typically comes with lower monthly payments compared to financing a car purchase. When you lease, you are essentially paying for the depreciation of the vehicle over the lease term, rather than the full cost of the car. This can result in more affordable monthly payments, allowing you to drive a newer or higher-end vehicle for less money.

2. Access to Newer Vehicles

Leasing a car allows you to regularly upgrade to newer models. Most lease terms are around 2-3 years, which means you can enjoy the latest features, technology, and safety advancements in the automotive industry. This is especially beneficial for those who prefer driving the latest vehicles and want to avoid the hassle of selling or trading in their cars every few years.

What are the disadvantages of leasing?

Leasing is a popular option for individuals and businesses looking to acquire assets without the upfront cost of purchasing. However, like any financial decision, there are pros and cons to consider. In this article, we will discuss the disadvantages of leasing, specifically focusing on finance leases.

Finance leases are a form of leasing where the lessee assumes most of the risks and rewards of ownership during the lease term. While they offer certain advantages, such as flexibility and potential tax benefits, there are also drawbacks to be aware of.

Should You Lease or Finance a Car? Pros and Cons of Finance Lease

When it comes to acquiring a new car, one of the most important decisions you’ll have to make is whether to lease or finance it. Both options have their advantages and disadvantages, so it’s crucial to weigh them carefully before making a choice. In this article, we will explore the pros and cons of finance lease, providing you with the information you need to make an informed decision.

A finance lease, also known as a car loan, involves borrowing money from a lender to purchase a vehicle. The borrower agrees to make monthly payments, including interest, over a predetermined period of time. At the end of the loan term, the borrower becomes the owner of the car.

What are the pros and cons of finance leasing?

In this article, we will explore the advantages and disadvantages of finance leasing. Finance leasing is a popular method used by businesses to acquire assets, such as equipment or vehicles, without the need for a large upfront payment. Instead, the business enters into a lease agreement with a leasing company, paying regular installments over an agreed period of time.

One of the main advantages of finance leasing is that it allows businesses to conserve their cash flow. Instead of making a significant upfront payment to purchase the asset, the business can spread the cost over a longer period of time. This can be particularly beneficial for businesses that require expensive equipment or vehicles but do not have the immediate funds available.

Leasing VS. Financing A Car | Is It Better To Buy Or Lease A New Car?

Frequently Asked Questions

Here are some common questions and answers regarding the pros and cons of finance lease:

1. What are the advantages of a finance lease?

Finance leases offer several benefits:

Firstly, finance leases provide businesses with the flexibility to acquire assets with minimal upfront cost. This can be particularly advantageous for companies that require expensive machinery or equipment.

Secondly, finance leases often come with lower monthly payments compared to other forms of financing, such as loans or hire purchase. This can help companies manage their cash flow more effectively and allocate resources to other areas of their business.

2. Are there any drawbacks to finance leases?

While finance leases can be beneficial, there are some potential drawbacks:

One disadvantage is that finance leases typically involve long-term commitments, often lasting for the useful life of the leased asset. This can limit the flexibility of businesses, as they may be locked into contracts even if their needs change.

Additionally, finance leases usually require regular payments, which can be a burden for businesses experiencing financial difficulties or cash flow challenges. Falling behind on lease payments can result in penalties or even the repossession of the leased asset.

3. How does a finance lease affect the balance sheet?

A finance lease affects the balance sheet by classifying the leased asset as a liability and recognizing the corresponding lease obligation. This allows the business to use the asset without showing it as an outright purchase.

On the asset side of the balance sheet, the leased asset is listed under “Property, Plant, and Equipment” or a similar category. On the liability side, the lease obligation is recorded as a long-term liability.

4. Can a finance lease be terminated early?

In most cases, finance leases are legally binding contracts with little flexibility for early termination. However, some lease agreements may include clauses or provisions for early termination, albeit with potential penalties or financial implications.

It is important for businesses to carefully review the terms and conditions of a finance lease before entering into the agreement to understand their options and potential consequences in case early termination becomes necessary.

5. How does a finance lease differ from an operating lease?

A finance lease and an operating lease differ in terms of ownership and accounting treatment:

In a finance lease, the lessee bears the risks and rewards of ownership and records the leased asset and corresponding liability on their balance sheet. The lessee is responsible for maintenance, insurance, and other costs associated with the asset.

On the other hand, an operating lease is more similar to renting. The lessor retains ownership of the asset, and the lessee does not record the leased asset or liability on their balance sheet. The lessor typically assumes responsibility for maintenance and other costs.

In summary, finance leases have both advantages and disadvantages. On the positive side, they allow businesses to acquire assets without a large upfront payment, providing flexibility and preserving cash flow. Finance leases also allow for a greater degree of control and ownership over the asset and may offer tax benefits. However, there are drawbacks to consider as well.

One major disadvantage of finance leases is the long-term commitment and potential financial burden. Businesses are obligated to make regular lease payments over the lease term, which can impact their financial flexibility. Additionally, the lessee is responsible for maintenance, insurance, and repairs, which can add to the overall cost. It is crucial for businesses to carefully assess their specific needs and financial situation before entering into a finance lease.

- Responsibility for Maintenance: As the owner of the asset, you are responsible for the maintenance and repair costs. This can add to the overall cost of the lease.

- Long-Term Commitment: Finance leases typically have longer terms compared to other lease options, which means you are committed to the asset for a longer period.

- Residual Value Risk: At the end of the lease term, you may be responsible for the residual value of the asset, which is the estimated value of the asset after depreciation. This can create uncertainty regarding the final cost of the lease.

- Ownership Obligations: While ownership is a benefit, it also means you are responsible for disposing of the asset once it is no longer needed. This can involve additional costs and logistical considerations.

What are the pros and cons of finance lease?

In this article, we will explore the advantages and disadvantages of finance lease, a popular form of lease financing. Understanding the pros and cons of finance lease can help businesses make informed decisions about their financing options.

A finance lease, also known as a capital lease, is a type of lease agreement where the lessee (the business) obtains the right to use an asset for a specific period of time in exchange for regular lease payments. At the end of the lease term, the lessee has the option to purchase the asset at a predetermined price, typically known as a residual value.

Advantages of Finance Lease

One of the main advantages of finance lease is that it allows businesses to acquire and use assets without the need for a large upfront capital investment. This is especially beneficial for small and medium-sized enterprises (SMEs) that may have limited financial resources.

Additionally, finance lease offers tax advantages for businesses. In many countries, lease payments can be treated as operating expenses and deducted from taxable income. This can result in lower tax liabilities for businesses, freeing up more cash for other operational needs.

Disadvantages of Finance Lease

One of the limitations of finance lease is that the lessee is responsible for the maintenance and repair costs of the leased asset. This can add additional expenses to the overall cost of leasing the asset, which may impact the financial viability of the arrangement.

Furthermore, because the lessee does not own the asset during the lease term, they are unable to benefit from any potential appreciation in the asset’s value. This means that they do not have the option to sell the asset or use it as collateral for other financing needs.

What are the advantages and disadvantages of finance leasing in business?

A finance lease is a popular method of acquiring assets for businesses. It allows businesses to use and benefit from assets without having to purchase them outright. Instead, the assets are leased over a specific period of time, with fixed monthly payments. This arrangement comes with its own set of advantages and disadvantages.

Advantages of Finance Leasing

There are several advantages of finance leasing for businesses:

- Cost-effective: Finance leasing allows businesses to acquire assets without a large upfront investment. Instead, they can make fixed monthly payments over a specific period of time, which helps with budgeting and cash flow management.

- Tax benefits: In many countries, finance lease payments can be deducted as a business expense, which can result in significant tax savings.

- Flexibility: Finance leasing gives businesses the flexibility to upgrade or replace assets easily. At the end of the lease term, businesses can choose to return the assets, purchase them at a predetermined price, or enter into a new lease agreement for upgraded assets.

- Access to latest technology: Leasing allows businesses to access and utilize the latest technology and equipment, without the need for significant capital investment.

- Off-balance sheet financing: Finance lease arrangements are considered off-balance sheet financing, which can improve a business’s financial ratios and make it more attractive to potential investors or lenders.

Disadvantages of Finance Leasing

Despite its advantages, finance leasing also has some disadvantages that businesses should consider:

- Higher overall cost: While finance leasing can be cost-effective in the short term, it may result in a higher overall cost compared to purchasing the assets outright. This is because businesses are essentially renting the assets and paying interest on the lease.

- Limited ownership rights: When leasing assets, businesses do not have full ownership rights. They are limited in how they can use, modify, or sell the assets.

- Long-term commitment: Finance lease agreements typically have a fixed term, which means businesses are committed to making regular payments for the entire duration of the lease. Exiting the lease early can result in penalties or additional costs.

- Depreciation risk: Businesses bear the risk of asset depreciation during the lease term. If the value of the assets significantly decreases, it may impact the business’s ability to recover the costs when returning or purchasing the assets.

Should you lease a car? Discover the pros and cons of finance lease

Leasing a car can be an attractive option for many individuals, providing a convenient and cost-effective way to drive a new vehicle. However, it’s important to weigh the advantages and disadvantages before making a decision. In this article, we’ll explore the pros and cons of finance lease, helping you determine whether it’s the right choice for you.

When considering a finance lease, it’s crucial to understand both the benefits and drawbacks. Let’s take a closer look at the advantages and disadvantages of leasing a car:

Advantages of Finance Lease

- Lower monthly payments compared to buying

- Ability to drive a new car every few years

- No need to worry about depreciation

- Minimal upfront costs

- Potential tax benefits for business use

Disadvantages of Finance Lease

- No ownership at the end of the lease term

- Mileage restrictions and penalties for exceeding them

- Additional costs for wear and tear

- Difficult to terminate the lease early

- Potential for higher insurance premiums

What are the disadvantages of leasing a car?

Leasing a car can have its advantages, but it also comes with a set of disadvantages. In this article, we will explore the drawbacks of leasing a car and help you make an informed decision.

When it comes to leasing a car, one of the main disadvantages is the lack of ownership. Unlike buying a car, where you eventually become the owner after paying off the loan, leasing only gives you temporary possession of the vehicle. This means that you don’t have the option to modify or customize the car to your liking.

Another disadvantage of leasing a car is the mileage restrictions. Most lease agreements come with a set mileage limit, and if you exceed that limit, you may have to pay additional fees. This can be a problem for people who have long commutes or enjoy road trips.

What are the advantages and disadvantages of leasing a car?

Leasing a car can be an attractive option for many individuals, but it’s important to understand the pros and cons before making a decision. In this article, we will explore the advantages and disadvantages of leasing a car, specifically focusing on finance lease arrangements.

First, let’s define what a finance lease is. A finance lease is a type of lease agreement where the lessee (the person leasing the car) assumes most of the risks and rewards of ownership. The lessee is responsible for maintenance and repairs, insurance, and other associated costs during the lease term. At the end of the lease, the lessee usually has the option to purchase the car at a predetermined price.

What are the advantages of leasing a car?

Leasing a car can offer several benefits compared to buying a vehicle outright. Let’s explore some of the advantages of leasing a car:

1. Lower Monthly Payments

One of the main advantages of leasing a car is that it typically comes with lower monthly payments compared to financing a car purchase. When you lease, you are essentially paying for the depreciation of the vehicle over the lease term, rather than the full cost of the car. This can result in more affordable monthly payments, allowing you to drive a newer or higher-end vehicle for less money.

2. Access to Newer Vehicles

Leasing a car allows you to regularly upgrade to newer models. Most lease terms are around 2-3 years, which means you can enjoy the latest features, technology, and safety advancements in the automotive industry. This is especially beneficial for those who prefer driving the latest vehicles and want to avoid the hassle of selling or trading in their cars every few years.

What are the disadvantages of leasing?

Leasing is a popular option for individuals and businesses looking to acquire assets without the upfront cost of purchasing. However, like any financial decision, there are pros and cons to consider. In this article, we will discuss the disadvantages of leasing, specifically focusing on finance leases.

Finance leases are a form of leasing where the lessee assumes most of the risks and rewards of ownership during the lease term. While they offer certain advantages, such as flexibility and potential tax benefits, there are also drawbacks to be aware of.

Should You Lease or Finance a Car? Pros and Cons of Finance Lease

When it comes to acquiring a new car, one of the most important decisions you’ll have to make is whether to lease or finance it. Both options have their advantages and disadvantages, so it’s crucial to weigh them carefully before making a choice. In this article, we will explore the pros and cons of finance lease, providing you with the information you need to make an informed decision.

A finance lease, also known as a car loan, involves borrowing money from a lender to purchase a vehicle. The borrower agrees to make monthly payments, including interest, over a predetermined period of time. At the end of the loan term, the borrower becomes the owner of the car.

What are the pros and cons of finance leasing?

In this article, we will explore the advantages and disadvantages of finance leasing. Finance leasing is a popular method used by businesses to acquire assets, such as equipment or vehicles, without the need for a large upfront payment. Instead, the business enters into a lease agreement with a leasing company, paying regular installments over an agreed period of time.

One of the main advantages of finance leasing is that it allows businesses to conserve their cash flow. Instead of making a significant upfront payment to purchase the asset, the business can spread the cost over a longer period of time. This can be particularly beneficial for businesses that require expensive equipment or vehicles but do not have the immediate funds available.

Leasing VS. Financing A Car | Is It Better To Buy Or Lease A New Car?

Frequently Asked Questions

Here are some common questions and answers regarding the pros and cons of finance lease:

1. What are the advantages of a finance lease?

Finance leases offer several benefits:

Firstly, finance leases provide businesses with the flexibility to acquire assets with minimal upfront cost. This can be particularly advantageous for companies that require expensive machinery or equipment.

Secondly, finance leases often come with lower monthly payments compared to other forms of financing, such as loans or hire purchase. This can help companies manage their cash flow more effectively and allocate resources to other areas of their business.

2. Are there any drawbacks to finance leases?

While finance leases can be beneficial, there are some potential drawbacks:

One disadvantage is that finance leases typically involve long-term commitments, often lasting for the useful life of the leased asset. This can limit the flexibility of businesses, as they may be locked into contracts even if their needs change.

Additionally, finance leases usually require regular payments, which can be a burden for businesses experiencing financial difficulties or cash flow challenges. Falling behind on lease payments can result in penalties or even the repossession of the leased asset.

3. How does a finance lease affect the balance sheet?

A finance lease affects the balance sheet by classifying the leased asset as a liability and recognizing the corresponding lease obligation. This allows the business to use the asset without showing it as an outright purchase.

On the asset side of the balance sheet, the leased asset is listed under “Property, Plant, and Equipment” or a similar category. On the liability side, the lease obligation is recorded as a long-term liability.

4. Can a finance lease be terminated early?

In most cases, finance leases are legally binding contracts with little flexibility for early termination. However, some lease agreements may include clauses or provisions for early termination, albeit with potential penalties or financial implications.

It is important for businesses to carefully review the terms and conditions of a finance lease before entering into the agreement to understand their options and potential consequences in case early termination becomes necessary.

5. How does a finance lease differ from an operating lease?

A finance lease and an operating lease differ in terms of ownership and accounting treatment:

In a finance lease, the lessee bears the risks and rewards of ownership and records the leased asset and corresponding liability on their balance sheet. The lessee is responsible for maintenance, insurance, and other costs associated with the asset.

On the other hand, an operating lease is more similar to renting. The lessor retains ownership of the asset, and the lessee does not record the leased asset or liability on their balance sheet. The lessor typically assumes responsibility for maintenance and other costs.

In summary, finance leases have both advantages and disadvantages. On the positive side, they allow businesses to acquire assets without a large upfront payment, providing flexibility and preserving cash flow. Finance leases also allow for a greater degree of control and ownership over the asset and may offer tax benefits. However, there are drawbacks to consider as well.

One major disadvantage of finance leases is the long-term commitment and potential financial burden. Businesses are obligated to make regular lease payments over the lease term, which can impact their financial flexibility. Additionally, the lessee is responsible for maintenance, insurance, and repairs, which can add to the overall cost. It is crucial for businesses to carefully assess their specific needs and financial situation before entering into a finance lease.

- Responsibility for Maintenance: As the owner of the asset, you are responsible for the maintenance and repair costs. This can add to the overall cost of the lease.

- Long-Term Commitment: Finance leases typically have longer terms compared to other lease options, which means you are committed to the asset for a longer period.

- Residual Value Risk: At the end of the lease term, you may be responsible for the residual value of the asset, which is the estimated value of the asset after depreciation. This can create uncertainty regarding the final cost of the lease.

- Ownership Obligations: While ownership is a benefit, it also means you are responsible for disposing of the asset once it is no longer needed. This can involve additional costs and logistical considerations.

What are the pros and cons of finance lease?

In this article, we will explore the advantages and disadvantages of finance lease, a popular form of lease financing. Understanding the pros and cons of finance lease can help businesses make informed decisions about their financing options.

A finance lease, also known as a capital lease, is a type of lease agreement where the lessee (the business) obtains the right to use an asset for a specific period of time in exchange for regular lease payments. At the end of the lease term, the lessee has the option to purchase the asset at a predetermined price, typically known as a residual value.

Advantages of Finance Lease

One of the main advantages of finance lease is that it allows businesses to acquire and use assets without the need for a large upfront capital investment. This is especially beneficial for small and medium-sized enterprises (SMEs) that may have limited financial resources.

Additionally, finance lease offers tax advantages for businesses. In many countries, lease payments can be treated as operating expenses and deducted from taxable income. This can result in lower tax liabilities for businesses, freeing up more cash for other operational needs.

Disadvantages of Finance Lease

One of the limitations of finance lease is that the lessee is responsible for the maintenance and repair costs of the leased asset. This can add additional expenses to the overall cost of leasing the asset, which may impact the financial viability of the arrangement.

Furthermore, because the lessee does not own the asset during the lease term, they are unable to benefit from any potential appreciation in the asset’s value. This means that they do not have the option to sell the asset or use it as collateral for other financing needs.

What are the advantages and disadvantages of finance leasing in business?

A finance lease is a popular method of acquiring assets for businesses. It allows businesses to use and benefit from assets without having to purchase them outright. Instead, the assets are leased over a specific period of time, with fixed monthly payments. This arrangement comes with its own set of advantages and disadvantages.

Advantages of Finance Leasing

There are several advantages of finance leasing for businesses:

- Cost-effective: Finance leasing allows businesses to acquire assets without a large upfront investment. Instead, they can make fixed monthly payments over a specific period of time, which helps with budgeting and cash flow management.

- Tax benefits: In many countries, finance lease payments can be deducted as a business expense, which can result in significant tax savings.

- Flexibility: Finance leasing gives businesses the flexibility to upgrade or replace assets easily. At the end of the lease term, businesses can choose to return the assets, purchase them at a predetermined price, or enter into a new lease agreement for upgraded assets.

- Access to latest technology: Leasing allows businesses to access and utilize the latest technology and equipment, without the need for significant capital investment.

- Off-balance sheet financing: Finance lease arrangements are considered off-balance sheet financing, which can improve a business’s financial ratios and make it more attractive to potential investors or lenders.

Disadvantages of Finance Leasing

Despite its advantages, finance leasing also has some disadvantages that businesses should consider:

- Higher overall cost: While finance leasing can be cost-effective in the short term, it may result in a higher overall cost compared to purchasing the assets outright. This is because businesses are essentially renting the assets and paying interest on the lease.

- Limited ownership rights: When leasing assets, businesses do not have full ownership rights. They are limited in how they can use, modify, or sell the assets.

- Long-term commitment: Finance lease agreements typically have a fixed term, which means businesses are committed to making regular payments for the entire duration of the lease. Exiting the lease early can result in penalties or additional costs.

- Depreciation risk: Businesses bear the risk of asset depreciation during the lease term. If the value of the assets significantly decreases, it may impact the business’s ability to recover the costs when returning or purchasing the assets.

Should you lease a car? Discover the pros and cons of finance lease

Leasing a car can be an attractive option for many individuals, providing a convenient and cost-effective way to drive a new vehicle. However, it’s important to weigh the advantages and disadvantages before making a decision. In this article, we’ll explore the pros and cons of finance lease, helping you determine whether it’s the right choice for you.

When considering a finance lease, it’s crucial to understand both the benefits and drawbacks. Let’s take a closer look at the advantages and disadvantages of leasing a car:

Advantages of Finance Lease

- Lower monthly payments compared to buying

- Ability to drive a new car every few years

- No need to worry about depreciation

- Minimal upfront costs

- Potential tax benefits for business use

Disadvantages of Finance Lease

- No ownership at the end of the lease term

- Mileage restrictions and penalties for exceeding them

- Additional costs for wear and tear

- Difficult to terminate the lease early

- Potential for higher insurance premiums

What are the disadvantages of leasing a car?

Leasing a car can have its advantages, but it also comes with a set of disadvantages. In this article, we will explore the drawbacks of leasing a car and help you make an informed decision.

When it comes to leasing a car, one of the main disadvantages is the lack of ownership. Unlike buying a car, where you eventually become the owner after paying off the loan, leasing only gives you temporary possession of the vehicle. This means that you don’t have the option to modify or customize the car to your liking.

Another disadvantage of leasing a car is the mileage restrictions. Most lease agreements come with a set mileage limit, and if you exceed that limit, you may have to pay additional fees. This can be a problem for people who have long commutes or enjoy road trips.

What are the advantages and disadvantages of leasing a car?

Leasing a car can be an attractive option for many individuals, but it’s important to understand the pros and cons before making a decision. In this article, we will explore the advantages and disadvantages of leasing a car, specifically focusing on finance lease arrangements.

First, let’s define what a finance lease is. A finance lease is a type of lease agreement where the lessee (the person leasing the car) assumes most of the risks and rewards of ownership. The lessee is responsible for maintenance and repairs, insurance, and other associated costs during the lease term. At the end of the lease, the lessee usually has the option to purchase the car at a predetermined price.

What are the advantages of leasing a car?

Leasing a car can offer several benefits compared to buying a vehicle outright. Let’s explore some of the advantages of leasing a car:

1. Lower Monthly Payments

One of the main advantages of leasing a car is that it typically comes with lower monthly payments compared to financing a car purchase. When you lease, you are essentially paying for the depreciation of the vehicle over the lease term, rather than the full cost of the car. This can result in more affordable monthly payments, allowing you to drive a newer or higher-end vehicle for less money.

2. Access to Newer Vehicles

Leasing a car allows you to regularly upgrade to newer models. Most lease terms are around 2-3 years, which means you can enjoy the latest features, technology, and safety advancements in the automotive industry. This is especially beneficial for those who prefer driving the latest vehicles and want to avoid the hassle of selling or trading in their cars every few years.

What are the disadvantages of leasing?

Leasing is a popular option for individuals and businesses looking to acquire assets without the upfront cost of purchasing. However, like any financial decision, there are pros and cons to consider. In this article, we will discuss the disadvantages of leasing, specifically focusing on finance leases.

Finance leases are a form of leasing where the lessee assumes most of the risks and rewards of ownership during the lease term. While they offer certain advantages, such as flexibility and potential tax benefits, there are also drawbacks to be aware of.

Should You Lease or Finance a Car? Pros and Cons of Finance Lease

When it comes to acquiring a new car, one of the most important decisions you’ll have to make is whether to lease or finance it. Both options have their advantages and disadvantages, so it’s crucial to weigh them carefully before making a choice. In this article, we will explore the pros and cons of finance lease, providing you with the information you need to make an informed decision.

A finance lease, also known as a car loan, involves borrowing money from a lender to purchase a vehicle. The borrower agrees to make monthly payments, including interest, over a predetermined period of time. At the end of the loan term, the borrower becomes the owner of the car.

What are the pros and cons of finance leasing?

In this article, we will explore the advantages and disadvantages of finance leasing. Finance leasing is a popular method used by businesses to acquire assets, such as equipment or vehicles, without the need for a large upfront payment. Instead, the business enters into a lease agreement with a leasing company, paying regular installments over an agreed period of time.

One of the main advantages of finance leasing is that it allows businesses to conserve their cash flow. Instead of making a significant upfront payment to purchase the asset, the business can spread the cost over a longer period of time. This can be particularly beneficial for businesses that require expensive equipment or vehicles but do not have the immediate funds available.

Leasing VS. Financing A Car | Is It Better To Buy Or Lease A New Car?

Frequently Asked Questions

Here are some common questions and answers regarding the pros and cons of finance lease:

1. What are the advantages of a finance lease?

Finance leases offer several benefits:

Firstly, finance leases provide businesses with the flexibility to acquire assets with minimal upfront cost. This can be particularly advantageous for companies that require expensive machinery or equipment.

Secondly, finance leases often come with lower monthly payments compared to other forms of financing, such as loans or hire purchase. This can help companies manage their cash flow more effectively and allocate resources to other areas of their business.

2. Are there any drawbacks to finance leases?

While finance leases can be beneficial, there are some potential drawbacks:

One disadvantage is that finance leases typically involve long-term commitments, often lasting for the useful life of the leased asset. This can limit the flexibility of businesses, as they may be locked into contracts even if their needs change.

Additionally, finance leases usually require regular payments, which can be a burden for businesses experiencing financial difficulties or cash flow challenges. Falling behind on lease payments can result in penalties or even the repossession of the leased asset.

3. How does a finance lease affect the balance sheet?

A finance lease affects the balance sheet by classifying the leased asset as a liability and recognizing the corresponding lease obligation. This allows the business to use the asset without showing it as an outright purchase.

On the asset side of the balance sheet, the leased asset is listed under “Property, Plant, and Equipment” or a similar category. On the liability side, the lease obligation is recorded as a long-term liability.

4. Can a finance lease be terminated early?

In most cases, finance leases are legally binding contracts with little flexibility for early termination. However, some lease agreements may include clauses or provisions for early termination, albeit with potential penalties or financial implications.

It is important for businesses to carefully review the terms and conditions of a finance lease before entering into the agreement to understand their options and potential consequences in case early termination becomes necessary.

5. How does a finance lease differ from an operating lease?

A finance lease and an operating lease differ in terms of ownership and accounting treatment:

In a finance lease, the lessee bears the risks and rewards of ownership and records the leased asset and corresponding liability on their balance sheet. The lessee is responsible for maintenance, insurance, and other costs associated with the asset.

On the other hand, an operating lease is more similar to renting. The lessor retains ownership of the asset, and the lessee does not record the leased asset or liability on their balance sheet. The lessor typically assumes responsibility for maintenance and other costs.

In summary, finance leases have both advantages and disadvantages. On the positive side, they allow businesses to acquire assets without a large upfront payment, providing flexibility and preserving cash flow. Finance leases also allow for a greater degree of control and ownership over the asset and may offer tax benefits. However, there are drawbacks to consider as well.

One major disadvantage of finance leases is the long-term commitment and potential financial burden. Businesses are obligated to make regular lease payments over the lease term, which can impact their financial flexibility. Additionally, the lessee is responsible for maintenance, insurance, and repairs, which can add to the overall cost. It is crucial for businesses to carefully assess their specific needs and financial situation before entering into a finance lease.

Cons of Finance Lease:

- Responsibility for Maintenance: As the owner of the asset, you are responsible for the maintenance and repair costs. This can add to the overall cost of the lease.

- Long-Term Commitment: Finance leases typically have longer terms compared to other lease options, which means you are committed to the asset for a longer period.

- Residual Value Risk: At the end of the lease term, you may be responsible for the residual value of the asset, which is the estimated value of the asset after depreciation. This can create uncertainty regarding the final cost of the lease.

- Ownership Obligations: While ownership is a benefit, it also means you are responsible for disposing of the asset once it is no longer needed. This can involve additional costs and logistical considerations.

What are the pros and cons of finance lease?

In this article, we will explore the advantages and disadvantages of finance lease, a popular form of lease financing. Understanding the pros and cons of finance lease can help businesses make informed decisions about their financing options.

A finance lease, also known as a capital lease, is a type of lease agreement where the lessee (the business) obtains the right to use an asset for a specific period of time in exchange for regular lease payments. At the end of the lease term, the lessee has the option to purchase the asset at a predetermined price, typically known as a residual value.

Advantages of Finance Lease

One of the main advantages of finance lease is that it allows businesses to acquire and use assets without the need for a large upfront capital investment. This is especially beneficial for small and medium-sized enterprises (SMEs) that may have limited financial resources.

Additionally, finance lease offers tax advantages for businesses. In many countries, lease payments can be treated as operating expenses and deducted from taxable income. This can result in lower tax liabilities for businesses, freeing up more cash for other operational needs.

Disadvantages of Finance Lease

One of the limitations of finance lease is that the lessee is responsible for the maintenance and repair costs of the leased asset. This can add additional expenses to the overall cost of leasing the asset, which may impact the financial viability of the arrangement.

Furthermore, because the lessee does not own the asset during the lease term, they are unable to benefit from any potential appreciation in the asset’s value. This means that they do not have the option to sell the asset or use it as collateral for other financing needs.

What are the advantages and disadvantages of finance leasing in business?

A finance lease is a popular method of acquiring assets for businesses. It allows businesses to use and benefit from assets without having to purchase them outright. Instead, the assets are leased over a specific period of time, with fixed monthly payments. This arrangement comes with its own set of advantages and disadvantages.

Advantages of Finance Leasing

There are several advantages of finance leasing for businesses:

- Cost-effective: Finance leasing allows businesses to acquire assets without a large upfront investment. Instead, they can make fixed monthly payments over a specific period of time, which helps with budgeting and cash flow management.

- Tax benefits: In many countries, finance lease payments can be deducted as a business expense, which can result in significant tax savings.

- Flexibility: Finance leasing gives businesses the flexibility to upgrade or replace assets easily. At the end of the lease term, businesses can choose to return the assets, purchase them at a predetermined price, or enter into a new lease agreement for upgraded assets.

- Access to latest technology: Leasing allows businesses to access and utilize the latest technology and equipment, without the need for significant capital investment.

- Off-balance sheet financing: Finance lease arrangements are considered off-balance sheet financing, which can improve a business’s financial ratios and make it more attractive to potential investors or lenders.

Disadvantages of Finance Leasing

Despite its advantages, finance leasing also has some disadvantages that businesses should consider:

- Higher overall cost: While finance leasing can be cost-effective in the short term, it may result in a higher overall cost compared to purchasing the assets outright. This is because businesses are essentially renting the assets and paying interest on the lease.

- Limited ownership rights: When leasing assets, businesses do not have full ownership rights. They are limited in how they can use, modify, or sell the assets.

- Long-term commitment: Finance lease agreements typically have a fixed term, which means businesses are committed to making regular payments for the entire duration of the lease. Exiting the lease early can result in penalties or additional costs.

- Depreciation risk: Businesses bear the risk of asset depreciation during the lease term. If the value of the assets significantly decreases, it may impact the business’s ability to recover the costs when returning or purchasing the assets.

Should you lease a car? Discover the pros and cons of finance lease

Leasing a car can be an attractive option for many individuals, providing a convenient and cost-effective way to drive a new vehicle. However, it’s important to weigh the advantages and disadvantages before making a decision. In this article, we’ll explore the pros and cons of finance lease, helping you determine whether it’s the right choice for you.

When considering a finance lease, it’s crucial to understand both the benefits and drawbacks. Let’s take a closer look at the advantages and disadvantages of leasing a car:

Advantages of Finance Lease

- Lower monthly payments compared to buying

- Ability to drive a new car every few years

- No need to worry about depreciation

- Minimal upfront costs

- Potential tax benefits for business use

Disadvantages of Finance Lease

- No ownership at the end of the lease term

- Mileage restrictions and penalties for exceeding them

- Additional costs for wear and tear

- Difficult to terminate the lease early

- Potential for higher insurance premiums

What are the disadvantages of leasing a car?

Leasing a car can have its advantages, but it also comes with a set of disadvantages. In this article, we will explore the drawbacks of leasing a car and help you make an informed decision.

When it comes to leasing a car, one of the main disadvantages is the lack of ownership. Unlike buying a car, where you eventually become the owner after paying off the loan, leasing only gives you temporary possession of the vehicle. This means that you don’t have the option to modify or customize the car to your liking.

Another disadvantage of leasing a car is the mileage restrictions. Most lease agreements come with a set mileage limit, and if you exceed that limit, you may have to pay additional fees. This can be a problem for people who have long commutes or enjoy road trips.

What are the advantages and disadvantages of leasing a car?

Leasing a car can be an attractive option for many individuals, but it’s important to understand the pros and cons before making a decision. In this article, we will explore the advantages and disadvantages of leasing a car, specifically focusing on finance lease arrangements.

First, let’s define what a finance lease is. A finance lease is a type of lease agreement where the lessee (the person leasing the car) assumes most of the risks and rewards of ownership. The lessee is responsible for maintenance and repairs, insurance, and other associated costs during the lease term. At the end of the lease, the lessee usually has the option to purchase the car at a predetermined price.

What are the advantages of leasing a car?

Leasing a car can offer several benefits compared to buying a vehicle outright. Let’s explore some of the advantages of leasing a car:

1. Lower Monthly Payments

One of the main advantages of leasing a car is that it typically comes with lower monthly payments compared to financing a car purchase. When you lease, you are essentially paying for the depreciation of the vehicle over the lease term, rather than the full cost of the car. This can result in more affordable monthly payments, allowing you to drive a newer or higher-end vehicle for less money.

2. Access to Newer Vehicles

Leasing a car allows you to regularly upgrade to newer models. Most lease terms are around 2-3 years, which means you can enjoy the latest features, technology, and safety advancements in the automotive industry. This is especially beneficial for those who prefer driving the latest vehicles and want to avoid the hassle of selling or trading in their cars every few years.

What are the disadvantages of leasing?

Leasing is a popular option for individuals and businesses looking to acquire assets without the upfront cost of purchasing. However, like any financial decision, there are pros and cons to consider. In this article, we will discuss the disadvantages of leasing, specifically focusing on finance leases.

Finance leases are a form of leasing where the lessee assumes most of the risks and rewards of ownership during the lease term. While they offer certain advantages, such as flexibility and potential tax benefits, there are also drawbacks to be aware of.

Should You Lease or Finance a Car? Pros and Cons of Finance Lease

When it comes to acquiring a new car, one of the most important decisions you’ll have to make is whether to lease or finance it. Both options have their advantages and disadvantages, so it’s crucial to weigh them carefully before making a choice. In this article, we will explore the pros and cons of finance lease, providing you with the information you need to make an informed decision.

A finance lease, also known as a car loan, involves borrowing money from a lender to purchase a vehicle. The borrower agrees to make monthly payments, including interest, over a predetermined period of time. At the end of the loan term, the borrower becomes the owner of the car.

What are the pros and cons of finance leasing?

In this article, we will explore the advantages and disadvantages of finance leasing. Finance leasing is a popular method used by businesses to acquire assets, such as equipment or vehicles, without the need for a large upfront payment. Instead, the business enters into a lease agreement with a leasing company, paying regular installments over an agreed period of time.

One of the main advantages of finance leasing is that it allows businesses to conserve their cash flow. Instead of making a significant upfront payment to purchase the asset, the business can spread the cost over a longer period of time. This can be particularly beneficial for businesses that require expensive equipment or vehicles but do not have the immediate funds available.

Leasing VS. Financing A Car | Is It Better To Buy Or Lease A New Car?

Frequently Asked Questions

Here are some common questions and answers regarding the pros and cons of finance lease:

1. What are the advantages of a finance lease?

Finance leases offer several benefits:

Firstly, finance leases provide businesses with the flexibility to acquire assets with minimal upfront cost. This can be particularly advantageous for companies that require expensive machinery or equipment.

Secondly, finance leases often come with lower monthly payments compared to other forms of financing, such as loans or hire purchase. This can help companies manage their cash flow more effectively and allocate resources to other areas of their business.

2. Are there any drawbacks to finance leases?

While finance leases can be beneficial, there are some potential drawbacks:

One disadvantage is that finance leases typically involve long-term commitments, often lasting for the useful life of the leased asset. This can limit the flexibility of businesses, as they may be locked into contracts even if their needs change.

Additionally, finance leases usually require regular payments, which can be a burden for businesses experiencing financial difficulties or cash flow challenges. Falling behind on lease payments can result in penalties or even the repossession of the leased asset.

3. How does a finance lease affect the balance sheet?

A finance lease affects the balance sheet by classifying the leased asset as a liability and recognizing the corresponding lease obligation. This allows the business to use the asset without showing it as an outright purchase.

On the asset side of the balance sheet, the leased asset is listed under “Property, Plant, and Equipment” or a similar category. On the liability side, the lease obligation is recorded as a long-term liability.

4. Can a finance lease be terminated early?

In most cases, finance leases are legally binding contracts with little flexibility for early termination. However, some lease agreements may include clauses or provisions for early termination, albeit with potential penalties or financial implications.

It is important for businesses to carefully review the terms and conditions of a finance lease before entering into the agreement to understand their options and potential consequences in case early termination becomes necessary.

5. How does a finance lease differ from an operating lease?

A finance lease and an operating lease differ in terms of ownership and accounting treatment:

In a finance lease, the lessee bears the risks and rewards of ownership and records the leased asset and corresponding liability on their balance sheet. The lessee is responsible for maintenance, insurance, and other costs associated with the asset.

On the other hand, an operating lease is more similar to renting. The lessor retains ownership of the asset, and the lessee does not record the leased asset or liability on their balance sheet. The lessor typically assumes responsibility for maintenance and other costs.

In summary, finance leases have both advantages and disadvantages. On the positive side, they allow businesses to acquire assets without a large upfront payment, providing flexibility and preserving cash flow. Finance leases also allow for a greater degree of control and ownership over the asset and may offer tax benefits. However, there are drawbacks to consider as well.

One major disadvantage of finance leases is the long-term commitment and potential financial burden. Businesses are obligated to make regular lease payments over the lease term, which can impact their financial flexibility. Additionally, the lessee is responsible for maintenance, insurance, and repairs, which can add to the overall cost. It is crucial for businesses to carefully assess their specific needs and financial situation before entering into a finance lease.

Cons of Finance Lease:

- Responsibility for Maintenance: As the owner of the asset, you are responsible for the maintenance and repair costs. This can add to the overall cost of the lease.

- Long-Term Commitment: Finance leases typically have longer terms compared to other lease options, which means you are committed to the asset for a longer period.

- Residual Value Risk: At the end of the lease term, you may be responsible for the residual value of the asset, which is the estimated value of the asset after depreciation. This can create uncertainty regarding the final cost of the lease.

- Ownership Obligations: While ownership is a benefit, it also means you are responsible for disposing of the asset once it is no longer needed. This can involve additional costs and logistical considerations.

What are the pros and cons of finance lease?