When it comes to home improvement in Ireland, finding the cheapest loan is essential. Did you know that according to recent statistics, the average cost of home renovations in Ireland can range from €10,000 to €30,000? That’s a significant expense, and finding an affordable loan can make all the difference.

The cheapest home improvement loan in Ireland can help homeowners fund their renovation projects without breaking the bank. With competitive interest rates and flexible repayment options, these loans provide a viable solution for those looking to enhance their home without draining their savings. Whether you need to update your kitchen, add an extension, or remodel your bathroom, a cost-effective loan can make your dream renovation a reality.

What is the most cost-effective method for borrowing funds against your home in Ireland?

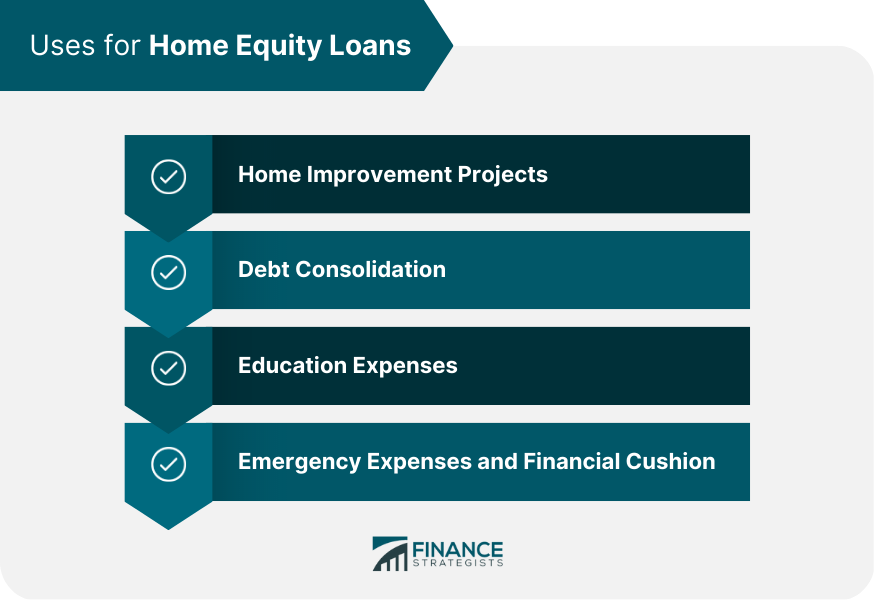

The cheapest way to borrow money from your home in Ireland is through a home improvement loan. This type of loan allows homeowners to access the equity built up in their property to fund renovations or repairs. By using your home as collateral, you can typically secure a lower interest rate compared to other types of loans, such as personal loans or credit cards. This makes a home improvement loan a cost-effective option for homeowners who need funds for home repairs or upgrades.

In Ireland, there are various lenders and financial institutions that offer home improvement loans at competitive rates. It’s important to shop around and compare different loan offers to ensure you find the most affordable option. Additionally, it’s crucial to carefully consider your repayment terms and any associated fees or charges before committing to a loan. By doing thorough research and making informed decisions, you can find the cheapest home improvement loan in Ireland that best suits your financial needs.

What is the current interest rate in Ireland?

When it comes to borrowing in Ireland, one important factor to consider is the current interest rate. The interest rate determines the cost of borrowing and can vary depending on various factors such as economic conditions, lending policies, and market competition. Understanding the current interest rate in Ireland is crucial for those who are looking for loans, mortgages, or other forms of credit.

The current interest rate in Ireland is set by the Central Bank and can be influenced by factors such as the European Central Bank’s monetary policy and the state of the Irish economy. It is important for individuals and businesses to stay informed about the current interest rate as it can affect their financial decisions.

Why are home improvement loans in Ireland so expensive?

Home improvement loans are often associated with high interest rates and fees, making them expensive for borrowers. There are several reasons why these loans tend to be costly in Ireland:

- Lack of Collateral: Home improvement loans are typically unsecured, meaning they do not require collateral. Lenders face higher risks when granting unsecured loans, which leads to higher interest rates to compensate for this risk.

- Higher Administrative Costs: The process of evaluating and approving home improvement loans involves significant administrative work, including paperwork, credit checks, and loan processing. These additional costs are often passed on to the borrower.

- Market Demand: The demand for home improvement loans may be high, resulting in lenders charging higher interest rates due to the scarcity of available funds. Market dynamics play a role in setting the cost of these loans.

However, it’s important for borrowers in Ireland to shop around and compare different lenders to find the cheapest home improvement loan. By comparing interest rates, fees, and terms, borrowers can find a loan that offers the best value for their specific needs and financial situation.

Should You Consider Pulling Equity Out of Your House?

When it comes to managing your home finances, one option you may have heard about is pulling equity out of your house. But is it a good idea? This article aims to provide an answer to this question and shed light on the advantages and considerations of tapping into the equity of your home.

Before we dive into the details, let’s briefly address the implied question related to the “cheapest home improvement loan in Ireland.” By pulling equity out of your house, you can potentially access funds to invest in your home and make those long-awaited improvements. Instead of opting for a traditional loan, tapping into the equity of your house may offer cost-effective financing options, making it a viable solution for homeowners seeking the cheapest home improvement loan in Ireland.

What is the most affordable calculator for home improvement loans in Ireland?

A home improvement loan calculator is a tool that helps individuals in Ireland determine the cost and affordability of borrowing money for home improvements. It allows users to input their loan amount, interest rate, and repayment term to calculate the monthly payments and total cost of the loan.

By using a home improvement loan calculator, individuals in Ireland can easily compare different loan options and find the most affordable one for their needs. This tool allows them to explore various loan amounts, interest rates, and repayment terms to determine which option best fits their budget and financial goals.

What are the benefits of a credit union home improvement loan?

A credit union home improvement loan is a type of loan provided by a credit union specifically for the purpose of financing home improvements. It is an affordable and convenient option for homeowners in Ireland looking to renovate or upgrade their homes.

One of the main advantages of a credit union home improvement loan is that it offers competitive interest rates, making it one of the cheapest home improvement loan options in Ireland. Credit unions are not-for-profit financial institutions, which means they can offer lower interest rates compared to traditional banks. This can result in significant savings over the life of the loan.

What is the cheapest home improvement loan in Ireland?

An Post offers a variety of home improvement loans to help homeowners in Ireland finance their renovation projects. These loans are designed to provide affordable and accessible funding options for individuals looking to improve their homes. With competitive interest rates and flexible repayment terms, An Post’s home improvement loans are a popular choice for those seeking the cheapest financing options in Ireland.

By choosing An Post for your home improvement loan in Ireland, you can enjoy the advantage of low interest rates and favorable loan terms. Whether you’re planning a small renovation or a major home improvement project, An Post’s loans can provide the necessary funds to turn your vision into reality. With their reputation for reliable service and commitment to customer satisfaction, An Post is a trusted source for affordable home improvement loans in Ireland.

What is the cheapest home improvement loan in Ireland?

A home improvement loan is a type of loan that is specifically designed to fund renovations or improvements on a property. It provides homeowners with the necessary funds to make upgrades to their homes, such as remodeling a kitchen, adding an extension, or renovating a bathroom. Home improvement loans typically have a specific term, such as 10 years, during which the loan must be repaid.

In Ireland, there are various options available for homeowners who are looking for the cheapest home improvement loan. These loans can be obtained from banks, credit unions, or other financial institutions. The interest rates and terms of the loan may vary depending on the lender and the borrower’s financial situation. It is important for homeowners to compare different loan options and consider factors such as interest rates, repayment terms, and any additional fees or charges before choosing the cheapest home improvement loan in Ireland.

What are the benefits of the cheapest home improvement loan in Ireland?

Home improvement loans are a type of financing that can help homeowners fund various renovation projects. These loans are specifically designed to cover the costs of making improvements or upgrades to a residential property. Whether you want to remodel your kitchen, add a new bathroom, or make energy-efficient upgrades, a home improvement loan can provide the necessary funds to complete these projects.

The cheapest home improvement loan in Ireland offers several advantages for homeowners. Firstly, it allows you to access the funds you need without depleting your savings or emergency funds. Instead of paying for the renovations upfront, you can spread the cost over time through affordable monthly payments. This can make it easier to manage your budget and ensure that the project doesn’t strain your finances.

What is the role of the government in providing home improvement loans?

A home improvement loan government refers to a loan program that is backed or supported by the government to help homeowners finance various renovations, repairs, or upgrades to their homes. These loans are typically offered with favorable terms and conditions, making them an attractive option for individuals looking to improve their homes.

The government plays a crucial role in providing home improvement loans as part of its efforts to promote affordable housing and stimulate economic growth. These loans are often offered through government agencies or programs, such as the Federal Housing Administration (FHA) or the Department of Housing and Urban Development (HUD). By providing financial assistance for home improvements, the government aims to enhance the quality of housing and increase property values in communities.

What is the cheapest home improvement loan in Ireland?

A home improvement loan is a type of loan that is specifically designed to finance renovations or upgrades to a property. It allows homeowners to borrow money to fund home improvement projects without having to use their own savings. The AIB Home Improvement Loan is one such loan option available in Ireland.

The AIB Home Improvement Loan is known for its competitive interest rates and flexible repayment options. It offers borrowers the opportunity to borrow funds for various home improvement purposes, such as remodeling a kitchen or bathroom, adding an extension, or installing energy-efficient features. With the AIB Home Improvement Loan, homeowners can access the necessary funds to enhance the comfort, functionality, and value of their property.

What is the cheapest home improvement loan in Ireland?

A home improvement loan can be a great solution for homeowners in Ireland who are looking to renovate or upgrade their homes. However, finding the cheapest option is crucial to ensure affordability and financial stability. If you’re wondering about the cheapest home improvement loan in Ireland, here’s everything you need to know:

A home improvement loan calculator provided by Bank of Ireland (BOI) can help you determine the cost of borrowing for your renovation project. It allows you to input various loan details such as loan amount, interest rate, and loan term to estimate the monthly repayments and total cost.

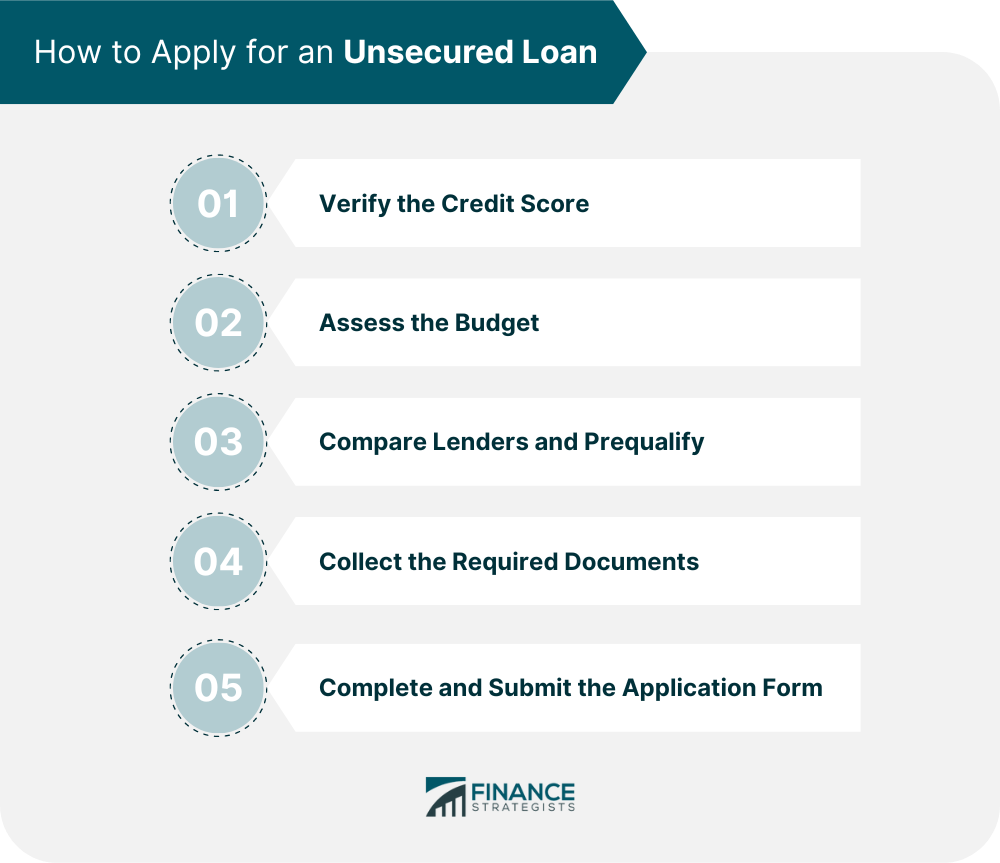

To conclude, if you are in Ireland and looking for the cheapest home improvement loan, there are a few key things to consider. First, shop around and compare interest rates offered by different lenders. Be sure to also check for any additional fees or charges associated with the loan.

Second, consider the loan term and repayment options that best suit your financial situation. A longer loan term may result in lower monthly payments, but could also mean paying more in interest over time. Lastly, make sure to review your credit score and improve it if needed, as a higher score can help you secure a better interest rate. By taking these steps and doing your research, you can find the cheapest home improvement loan in Ireland that meets your needs.