When it comes to home improvements, wouldn’t it be great if you could make them tax deductible? Imagine getting a tax break for renovating your kitchen or adding a new room to your house. Well, it turns out that it is possible to make certain home improvements tax deductible, and I’m here to show you how.

One important aspect to consider when trying to make home improvements tax deductible is to understand the rules and regulations set by the tax authorities. The Internal Revenue Service (IRS) allows homeowners to deduct certain expenses related to home improvements from their taxes, but there are specific requirements that must be met. For example, the improvements must be considered “capital improvements” and add value to your home, rather than mere repairs or maintenance. Understanding these guidelines is crucial in order to maximize your tax benefits.

How can I make my home improvements tax deductible?

When it comes to home improvements, many homeowners wonder if they can make them tax deductible. The Internal Revenue Service (IRS) does allow for certain home improvements to be tax deductible, but it’s important to understand the rules and guidelines to take full advantage of this potential tax benefit.

The key to making home improvements tax deductible is to ensure that they qualify as eligible expenses according to the IRS guidelines. Some common examples of home improvements that may be tax deductible include energy-efficient upgrades, medically necessary modifications, and improvements related to home office spaces. However, it is crucial to consult a tax professional or refer to the IRS guidelines to determine specific eligibility requirements and limitations.

Can You Deduct a Bathroom Remodel on Your Taxes?

When it comes to home improvements, many homeowners wonder if they can deduct the expenses on their taxes. One popular renovation project is a bathroom remodel, which can not only enhance the functionality and aesthetics of your bathroom but potentially provide some tax benefits as well.

To determine whether a bathroom remodel is tax deductible, it’s important to understand the criteria the Internal Revenue Service (IRS) sets forth. Generally, the IRS does not allow you to deduct the entire cost of a bathroom remodel as a direct expense on your tax return. However, there are certain circumstances where you may be able to claim some tax deductions.

Can Home Improvements be Tax Deductible for Those Working from Home?

Learn how to make home improvements tax deductible for individuals who work from home.

Home improvements are a common way to enhance the comfort, aesthetics, and functionality of a home. They can range from minor upgrades like installing new light fixtures to major renovations such as adding a home office or expanding living spaces. But did you know that certain home improvements can be tax deductible for individuals who work from home?

When you work from home, you may be able to claim deductions for a portion of your home expenses, including eligible home improvements. However, it’s important to understand the specific criteria and requirements to ensure you comply with tax laws and maximize your tax benefits.

Can You Deduct the Cost of New Flooring on Your Taxes?

When it comes to making home improvements, many homeowners wonder if they can deduct the cost of new flooring on their taxes. This question arises from the desire to make these expenses more affordable and potentially offset some of the costs. While there is no straightforward answer, understanding the tax rules and regulations can help clarify whether you can make your home improvement project tax deductible.

The tax deductibility of new flooring largely depends on the purpose of the improvement and the type of property you own. In general, home improvements that increase the value, prolong the lifespan, or adapt the property for a specific medical condition may be eligible for tax deductions. However, for personal residences, the expenses are typically considered personal in nature and are not tax deductible. On the other hand, if you own a rental property or use a portion of your home for business purposes, you may have more options for making your new flooring tax deductible.

How can I make my home improvements tax deductible?

Homeowners often wonder if there are any tax deductions available for their home improvement projects. The good news is that, in certain cases, you can make your home improvements tax deductible. By taking advantage of the tax benefits provided by the IRS, you may be able to reduce your overall tax liability while enhancing your living space.

To make your home improvements tax deductible, you need to meet certain criteria set by the IRS. First, the improvements must be considered as capital expenses, which means they enhance the value of your property or prolong its useful life. Examples of qualifying improvements include adding a new room, renovating the kitchen or bathroom, installing a new roof, or improving the energy efficiency of your home.

What Home Improvements Can Be Tax Deductible in 2023?

When it comes to making home improvements, many homeowners wonder if they can get any tax benefits. The good news is that certain home improvements can be tax deductible in 2023, allowing you to potentially save money on your taxes. To take advantage of these deductions, it’s important to understand what home improvements qualify and how to navigate the tax regulations effectively.

To make home improvements tax deductible in 2023, they must meet specific criteria set by the Internal Revenue Service (IRS). Generally, these deductions fall under the category of home improvements that increase the value of your property, improve its energy efficiency, or accommodate medical needs. Examples of qualifying home improvements include:

- Installing solar panels or energy-efficient windows

- Adding a home office or workspace

- Modifying your home for accessibility

- Upgrading your heating, ventilation, and air conditioning (HVAC) system

- Renovating your kitchen or bathroom

However, it’s important to note that not all home improvements are tax deductible in 2023. Cosmetic enhancements, such as painting or landscaping, typically do not qualify for deductions. Additionally, the amount you can deduct for eligible home improvements may be subject to certain limitations and restrictions, so it’s crucial to consult with a tax professional or refer to the latest IRS guidelines.

Can I Make Home Improvements Tax Deductible in California?

Making home improvements tax deductible in California can provide significant financial benefits for homeowners. By taking advantage of certain tax deductions and credits, homeowners can potentially reduce their tax liability and save money. Below, we will explore the various strategies and requirements for making home improvements tax deductible in California.

One way to make home improvements tax deductible in California is by utilizing the Residential Energy Efficient Property Credit. This federal tax credit allows homeowners to claim a percentage of the cost of qualifying energy-efficient improvements, such as solar panels or energy-efficient windows. By installing these types of improvements, homeowners can not only save on their energy bills but also enjoy a tax benefit.

How Can I Make Home Improvements Tax Deductible for Rental Property?

When it comes to rental property, many landlords wonder if they can make home improvements tax deductible. Making improvements to your rental property can be costly, but if done correctly, they can also provide you with potential tax benefits. By understanding the rules and regulations surrounding tax deductions for home improvements on rental properties, you can maximize your deductions and potentially save money.

One way to make home improvements tax deductible for rental property is by categorizing them as repairs or capital improvements. Repairs are considered to be regular maintenance and upkeep expenses, such as fixing a leaky faucet or replacing broken windows. These repairs can generally be deducted in the year they were made. On the other hand, capital improvements are significant renovations or additions that improve the value or extend the useful life of the property, such as remodeling a kitchen or adding a new bathroom. Capital improvements are not deductible in the year they were made, but they can be depreciated over time, which can help offset your rental income.

Are Home Improvements Tax Deductible in California?

When it comes to making home improvements, many homeowners wonder whether they can deduct the expenses on their taxes. In California, the rules regarding tax deductions for home improvements can be a bit complex. However, there are certain situations where you may be able to make your home improvements tax deductible, potentially saving you money in the process.

In order to make your home improvements tax deductible in California, it’s important to understand the criteria that must be met. Generally, home improvements that are made for medical purposes or to accommodate a disability may be eligible for a tax deduction. Additionally, certain energy-efficient home improvements may also qualify for tax credits in California.

Is a New Roof Tax Deductible in 2023?

Are you wondering if you can deduct the cost of a new roof on your taxes in 2023? Find out the answer and explore the tax benefits of making home improvements deductible.

When it comes to home improvements, it’s important to understand the tax implications. While not all home improvements are tax deductible, some can provide significant tax benefits. Making certain home improvements tax deductible allows you to reduce your taxable income and potentially save money on your taxes.

Are New Gutters Tax Deductible: A Guide to Making Home Improvements Tax Deductible

When it comes to making home improvements, many homeowners wonder if they can take advantage of tax deductions. One common question is whether new gutters are tax deductible. In this guide, we will explore the topic of making home improvements tax deductible and provide you with the information you need to know.

Home improvements, such as installing new gutters, can potentially be tax deductible under certain circumstances. However, it is important to understand the specific requirements and guidelines set by the Internal Revenue Service (IRS) to ensure you qualify for these deductions.

How to Make Home Improvements Tax Deductible?

When it comes to selling your home, making certain improvements can increase its value and attract potential buyers. But did you know that some home improvements can also be tax deductible? If you’re wondering how to make home improvements tax deductible, we’ve got you covered. In this article, we will explore the different home improvements that may qualify for tax deductions when selling your home.

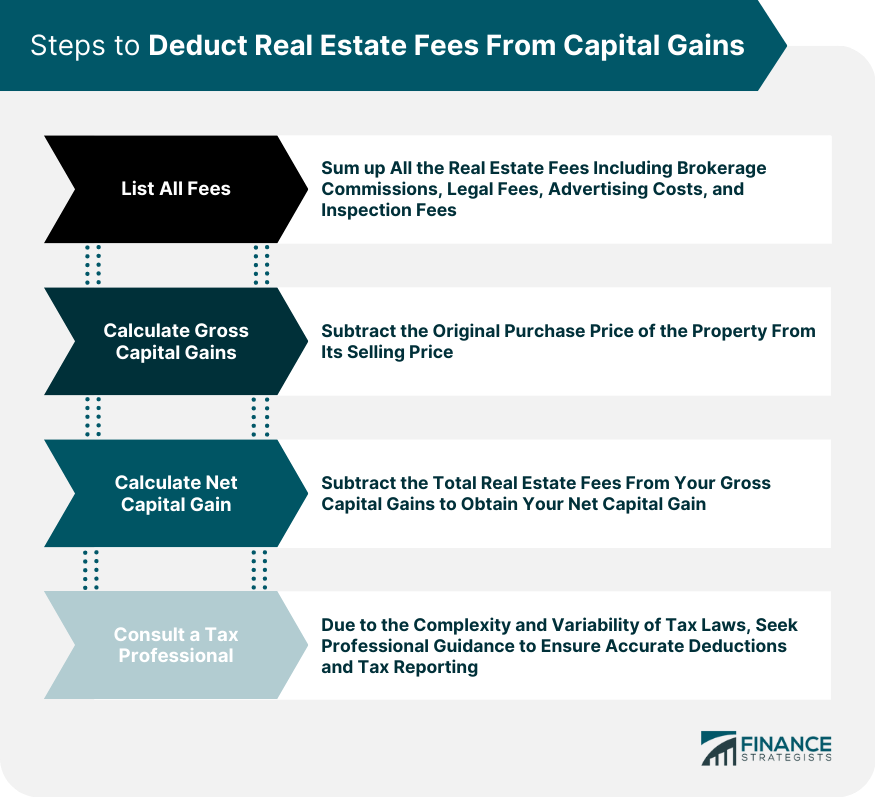

Before diving into the specific home improvements that can be tax deductible, it’s important to understand the concept of tax deductions. A tax deduction is a reduction in your taxable income, which in turn can lower the amount of taxes you owe. When it comes to home improvements, certain expenses can be deducted from the capital gains tax you may owe when selling your home.

In conclusion, there are several ways to make home improvements tax deductible. Firstly, if the improvements are made for medical reasons, they may be eligible for a tax deduction if they exceed a certain percentage of your income. Secondly, if the improvements are made for energy efficiency purposes, such as installing solar panels or energy-efficient windows, you may qualify for tax credits. Thirdly, if the improvements are made to accommodate a disability, they may be tax deductible as medical expenses.

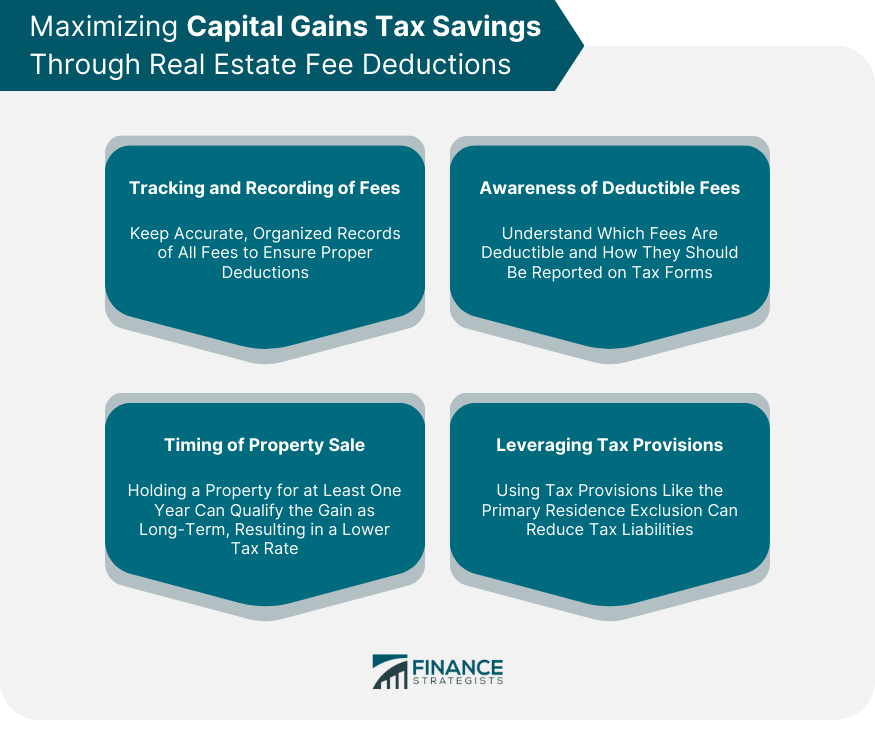

It’s important to keep detailed records of all home improvement expenses, including receipts, contracts, and invoices. Consult with a tax professional or accountant who can provide guidance on which improvements are eligible for tax deductions and credits. Remember, tax laws can change, so it’s important to stay informed and up to date with any revisions or updates that may affect the tax deductibility of home improvements.