When it comes to home improvement projects, many homeowners wonder if they can deduct the interest paid on their loan. The answer may surprise you.

As of 2021, the answer is no. The Tax Cuts and Jobs Act of 2017 eliminated the deduction for home equity loan interest, including interest on loans used for home improvements. However, there are still other valuable deductions and tax incentives available for homeowners, so it’s essential to explore all your options when it comes to maximizing your tax benefits.

Can You Deduct Interest from a Home Improvement Loan?

Here’s everything you need to know about deducting interest from a home improvement loan.

A home improvement loan is a type of loan taken out to fund renovations, repairs, or upgrades to a property. It is specifically used for making improvements to one’s home, such as adding a new room, remodeling a kitchen, or installing energy-efficient features. These loans are often secured by the property itself, meaning that if the borrower is unable to repay the loan, the lender can foreclose on the property to recover their money.

When it comes to tax benefits, the interest on a home improvement loan may be deductible in certain situations. The Internal Revenue Service (IRS) allows for the deduction of mortgage interest on loans used to improve a qualified residence, which includes both a main home and a second home. However, there are certain criteria that need to be met in order to claim this deduction.

Are Home Improvements Tax Deductible according to the IRS?

When it comes to home improvements, many homeowners wonder if they can get any tax benefits from their renovation projects. The Internal Revenue Service (IRS) provides guidelines on which home improvements can be tax deductible. Let’s explore whether you can deduct home improvement loan interest and understand the tax deductions related to home improvements.

Deducting Home Improvement Loan Interest

If you have taken out a loan specifically for home improvement purposes, you may be eligible to deduct the interest paid on that loan. The IRS allows homeowners to deduct the interest on home improvement loans as long as the loan is used to make significant improvements to their primary residence or a second home. These improvements must add value to the property or prolong its useful life.

However, it’s important to note that not all home improvement loans qualify for tax deductions. Personal loans or lines of credit used for home improvements may not be eligible for deduction. To ensure eligibility, it’s crucial to consult with a tax professional or refer to the IRS guidelines to determine if your loan qualifies for a deduction.

Is it Possible to Deduct Home Improvement Purchases?

When it comes to home improvements, many homeowners wonder if they can write off their purchases. In other words, can you deduct the expenses incurred during home improvement projects on your taxes? The answer to this question depends on several factors, including the nature of the improvement, your tax situation, and the specific guidelines provided by the tax authorities.

The ability to deduct home improvement purchases largely revolves around whether the improvement qualifies as a capital expense or it can be considered as a repair or maintenance expense. Generally, capital expenses, which are substantial investments in your property that increase its value or extend its useful life, cannot be fully deducted in the year of purchase. Instead, they are typically depreciated over a number of years.

Which Loans Can You Deduct for Tax Purposes?

Are you wondering which loans are eligible for tax deductions? One common question that often arises is whether home improvement loan interest can be deducted. In this article, we will explore the types of loans that are typically eligible for tax deductions and provide a concise answer to the question of deducting home improvement loan interest.

Types of Loans Eligible for Tax Deductions

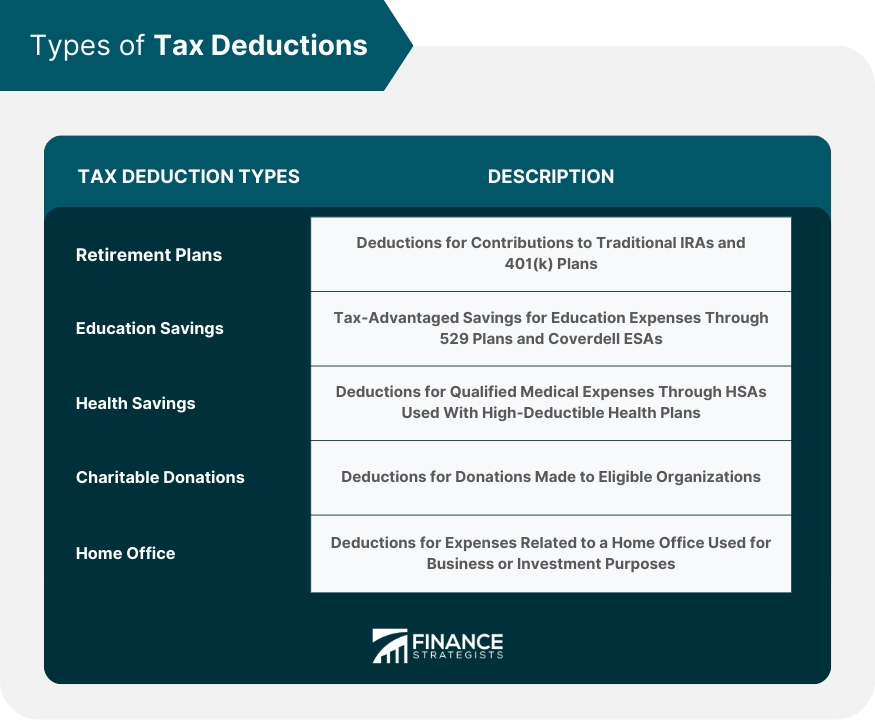

When it comes to deducting loan interest for tax purposes, there are several types of loans that may be eligible:

- Mortgage loans: Interest paid on mortgage loans for both primary residences and second homes is generally tax deductible, up to certain limits.

- Student loans: Interest paid on student loans may also be eligible for tax deductions, depending on income level and other factors.

- Business loans: If you have taken out a loan for business purposes, the interest paid on that loan may be deductible as a business expense.

Can You Deduct Home Improvement Loan Interest?

Now, let’s address the specific question of whether home improvement loan interest can be deducted for tax purposes. In most cases, the interest paid on home improvement loans is not tax deductible. However, there may be exceptions for certain situations:

- If the home improvement loan is considered a “secured loan” and the improvements directly increase the value of your home, a portion of the interest may be deductible. It’s recommended to consult with a tax professional to determine the eligibility and specific details.

- If the home improvement loan is taken out to make energy-efficient upgrades to your home, such as installing solar panels or energy-efficient windows, you may be eligible for certain tax credits or deductions. Again, consulting with a tax professional is advisable to understand the specific rules and requirements.

Which Home Improvements Are Tax Deductible in 2023?

When it comes to home improvements, many homeowners wonder which expenses can be deducted on their taxes. If you’re planning to make improvements to your home in 2023, it’s important to understand what expenses may be eligible for tax deductions. While not all home improvements are tax deductible, certain types of expenses can potentially qualify for deductions. One common question that arises is whether you can deduct home improvement loan interest. Let’s explore this topic further and find out.

Can You Deduct Home Improvement Loan Interest?

Home improvement loan interest refers to the interest paid on loans taken out specifically for making improvements to your home. The good news is that in many cases, you can deduct the interest paid on these loans from your taxes. However, there are certain criteria that need to be met in order to qualify for this deduction.

What Home Improvements Can You Deduct on Your Taxes in 2022?

When it comes to tax deductions, homeowners are often curious about which home improvements they can claim. In 2022, there are several types of home improvements that may be eligible for tax deductions. These deductions can help homeowners save money and potentially reduce their tax liability. However, it’s important to understand the specific rules and qualifications to determine if your home improvements are tax deductible.

One common question homeowners have is whether they can deduct the interest on a home improvement loan. The answer is, it depends. In general, the interest on a home improvement loan is not tax deductible unless the loan meets certain criteria. The IRS allows deductions on home mortgage interest, but there are specific guidelines that must be followed. To qualify for a deduction, the loan must be used to make substantial improvements to your primary residence or a second home. The improvements must also add value to the property and be considered a capital expense.

Is the Interest on a Home Equity Loan Tax Deductible?

When it comes to financing home improvements, many homeowners turn to home equity loans as a viable option. These loans allow you to borrow against the equity in your home, providing you with the funds needed to make renovations, repairs, or other improvements. One question that often arises is whether the interest paid on a home equity loan is tax deductible.

The good news is that in many cases, the interest on a home equity loan is indeed tax deductible. However, there are certain criteria that must be met in order to qualify for this deduction. Generally, as long as the funds from the loan are used to improve your home, the interest paid on the loan may be eligible for a tax deduction.

Can You Deduct Home Improvement Expenses if You Work from Home?

When it comes to working from home, many individuals wonder if they can write off home improvements as business expenses. This article explores whether you can deduct home improvement expenses when you work from home.

Home improvements such as renovations, repairs, or additions can enhance the functionality and aesthetics of your living space. However, if you use a portion of your home for business purposes, you may be eligible to deduct some of these expenses as business expenses.

Are Home Improvement Loan Interest Deductions Allowed by the IRS?

Homeowners often wonder if they can deduct the interest paid on their home improvement loans. It is important to understand the rules set by the Internal Revenue Service (IRS) regarding home improvement loan interest deductions. Let’s delve into the topic to find out if you can take advantage of this deduction.

According to the IRS, home improvement loan interest may be tax-deductible if the loan is used to make substantial improvements to your primary residence. These improvements must add value to your home, prolong its useful life, or adapt it to new uses. However, it is important to note that not all home improvement expenses qualify for deductions.

Is Home Equity Loan Interest Tax Deductible in 2023?

Homeowners often wonder if they can deduct home equity loan interest on their taxes, especially in a specific year like 2023. Let’s explore whether home equity loan interest is tax deductible and the implications for homeowners.

When it comes to home equity loan interest, the tax deductibility depends on a few factors. In general, the interest on a home equity loan is tax deductible if the loan is used for qualified expenses related to your home.

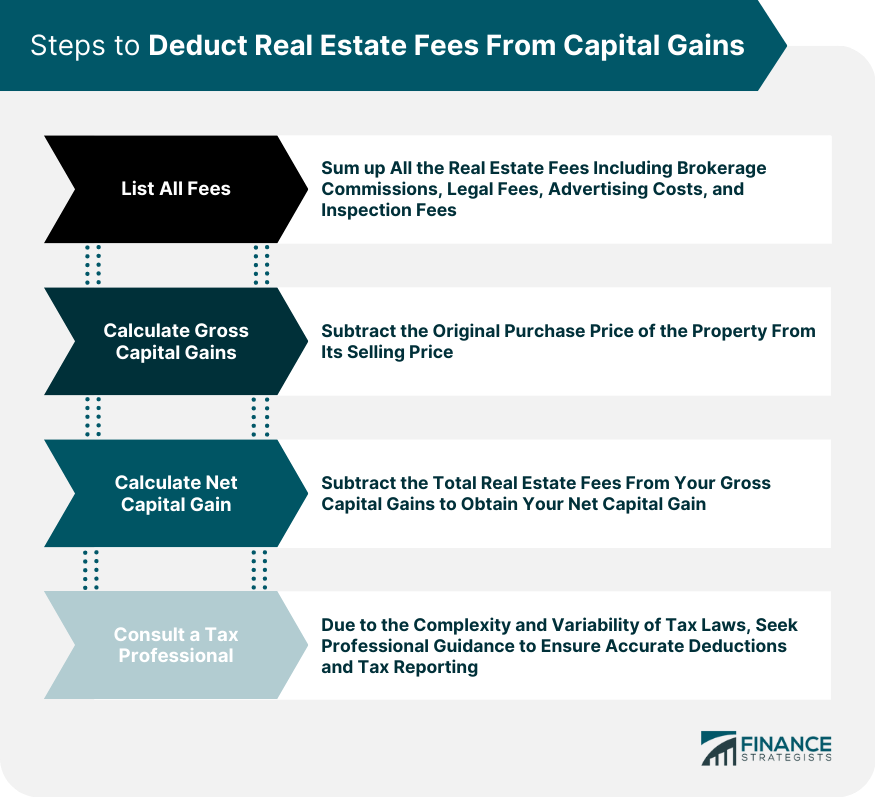

What Home Improvements Can You Deduct When Selling?

When it comes to selling your home, you may be wondering which home improvements you can deduct for tax purposes. This is an important question to consider, as deducting certain home improvement expenses can help reduce your taxable income and potentially save you money. In this article, we will explore the tax-deductible home improvements you can make when selling your home.

One common question homeowners have is whether they can deduct the interest on a home improvement loan. The answer to this question depends on the specific circumstances and purpose of the loan.

Can You Deduct Home Improvement Loan Interest on Rental Property?

When it comes to owning rental property, you may be wondering if you can deduct the interest on a home improvement loan. This question arises because as a landlord, you are always looking for ways to maximize your tax deductions and minimize your expenses. To determine whether you can deduct home improvement loan interest on rental property, it is important to understand the rules and regulations set forth by the Internal Revenue Service (IRS).

The IRS allows landlords to deduct certain expenses related to their rental properties. However, the deductibility of home improvement loan interest depends on several factors, including the purpose of the loan and the nature of the improvements made. Let’s explore these factors in more detail.

In conclusion, yes, you can deduct home improvement loan interest in certain circumstances. If the improvements are considered to be substantial and add value to your home, you may be eligible to deduct the interest paid on the loan. However, there are several conditions that need to be met in order to qualify for this deduction.

Firstly, the loan must be secured by your main home or second home, and the improvements must be for the property you are claiming the deduction for. Additionally, the loan must be used to improve the value of the property, rather than for personal expenses or repairs. Lastly, there are limitations on the amount of interest you can deduct depending on the size of the loan.